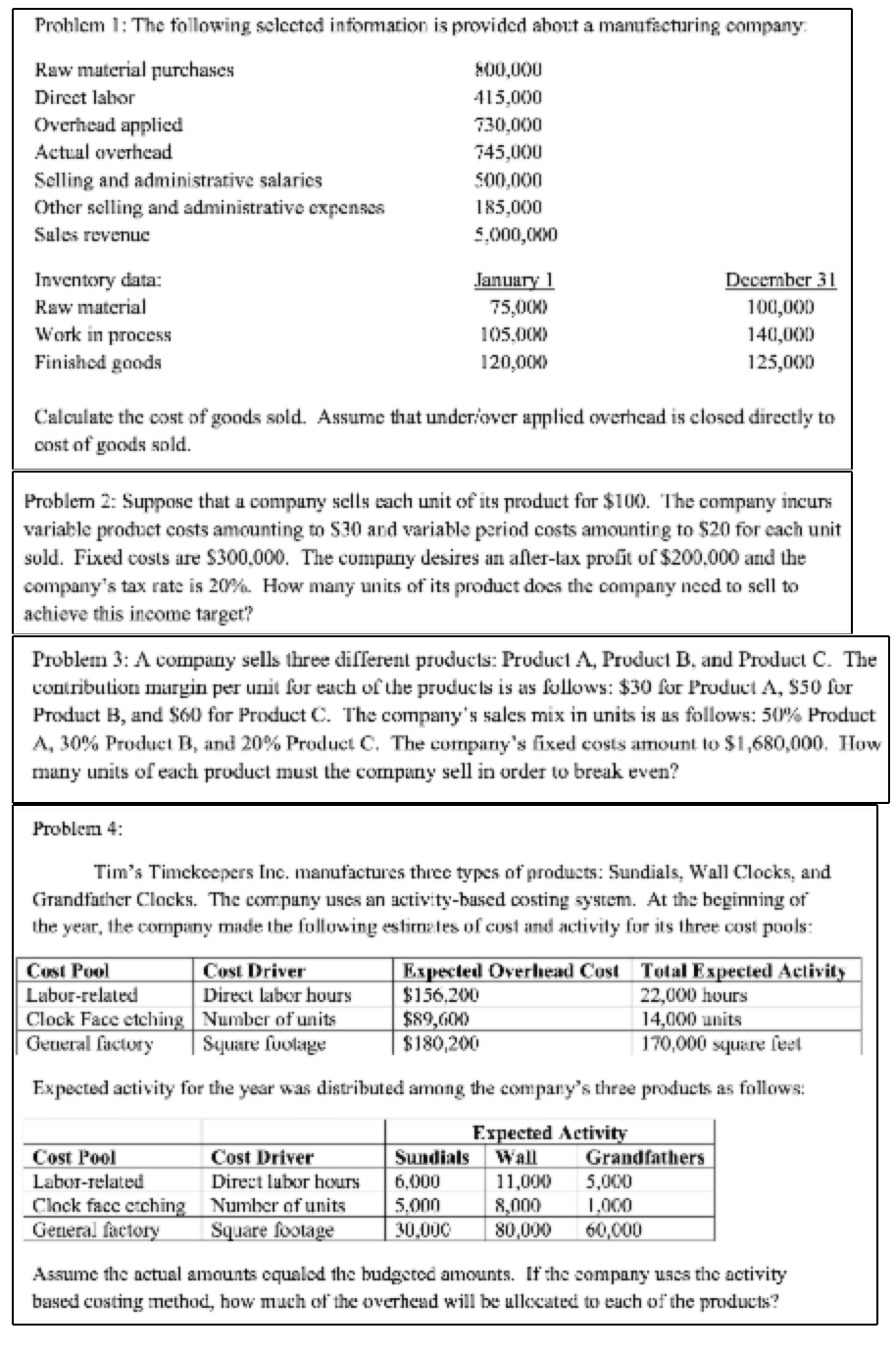

Question: Problem 1: The following selected intomation is provided about a manufacturing company Raw material purchases 800,000 Direct labor 415,000 Overhead applied 730,000 Actual overhead 745,000

Problem 1: The following selected intomation is provided about a manufacturing company Raw material purchases 800,000 Direct labor 415,000 Overhead applied 730,000 Actual overhead 745,000 Selling and administrative salaries 500,000 Other selling and administrative expenses 185,000 Sales revenue 5.000,00 Inventory data: Raw material Work in process Finished goods January 1 75,00K) 105.00) 120,000) December 31 100,000 140,000 125,000 Calculate the cost of goods sold. Assume that under over applied overhead is closed directly to cost of goods sold. Problem 2: Suppose that a company sells each unit of its product for $100. The company incurs variable product costs amounting to S80 and variable period costs amounting to $20 for each unit sold. Fixed costs are $300,000. The company desires an aller-lax profit of $200.000 and the company's tax rate is 20%. How many units of its product dox the company need to sell to achieve this income target? Problem 3: A company sells three different products: Product A, Product B. and Product C. The contribution margin per unit for each of the products is as follows: $30 for Product A, $50 fur Product B, and $60 for Product C. The company's sales mix in units is as follows: 50% Product A, 30% Product B, and 20% Product C. The company's fixed costs amount to $1,680,000. How muny units of each product must the company sell in order to break even? Problem 4: Tim's Timekeepers Inc. manufactures three types of products: Sundials, Wall Clocks, and Grandfather Clocks. The company uses an activity-based costing system. At the beginning of the year, the company made the following estimates of cost and activity for ils three cost pools: Cost Pool Cost Driver Espected Overhead Cost Total Expected Activity Labur-related Direct labor hours $156,200 22,000 hours Clock Face ctching Number of units $89,600) 14,000 units General factory Square uolage $180,200 170,000 square feet Expected activity for the year was distributed among the company's three products as follows: Cost Pool Cost Driver Labor-related Direct lubor hours Clock facc ctching Number of units General factory Square footage Expected Activity Sundials Wall Grandfathers 6.000 11,000 5.000 5.000 8,000 1.000 20.000 80,000 60,000 Assume the actual amounts equaled the budgeted amounts. If the company was the activity based costing method, how much of the overhead will be allocated to each of the products

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts