Question: Problem 1 The Malakas Manufacturing Corp. started operations in January 2011: Jan 2 Purchased on account 1,000 units of Material X at P20 per piece.

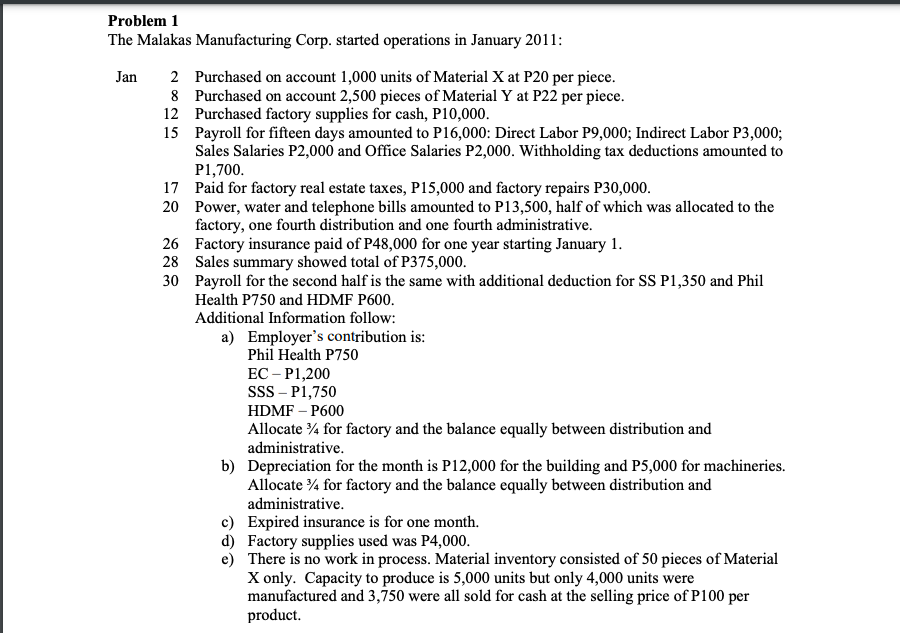

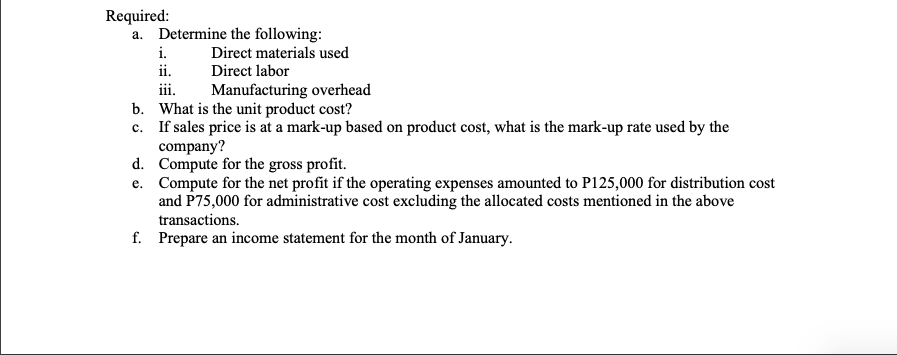

Problem 1 The Malakas Manufacturing Corp. started operations in January 2011: Jan 2 Purchased on account 1,000 units of Material X at P20 per piece. 8 Purchased on account 2,500 pieces of Material Y at P22 per piece. 12 Purchased factory supplies for cash, P10,000. 15 Payroll for fifteen days amounted to P16,000: Direct Labor P9,000; Indirect Labor P3,000; Sales Salaries P2,000 and Office Salaries P2,000. Withholding tax deductions amounted to P1,700. 17 Paid for factory real estate taxes, P15,000 and factory repairs P30,000. 20 Power, water and telephone bills amounted to P13,500, half of which was allocated to the factory, one fourth distribution and one fourth administrative. 26 Factory insurance paid of P48,000 for one year starting January 1. 28 Sales summary showed total of P375,000. 30 Payroll for the second half is the same with additional deduction for SS P1,350 and Phil Health P750 and HDMF P600. Additional Information follow: a) Employer's contribution is: Phil Health P750 EC - P1,200 SSS - P1,750 HDMF-P600 Allocate % for factory and the balance equally between distribution and administrative. b) Depreciation for the month is P12,000 for the building and P5,000 for machineries. Allocate 4 for factory and the balance equally between distribution and administrative. c) Expired insurance is for one month. d) Factory supplies used was P4,000. e) There is no work in process. Material inventory consisted of 50 pieces of Material X only. Capacity to produce is 5,000 units but only 4,000 units were manufactured and 3,750 were all sold for cash at the selling price of P100 per product Required: a. Determine the following: i. Direct materials used ii. Direct labor iii. Manufacturing overhead b. What is the unit product cost? c. If sales price is at a mark-up based on product cost, what is the mark-up rate used by the company? d. Compute for the gross profit. e. Compute for the net profit if the operating expenses amounted to P125,000 for distribution cost and P75,000 for administrative cost excluding the allocated costs mentioned in the above transactions. f. Prepare an income statement for the month of January

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts