Question: PROBLEM 1 The Three Stooges Production Company uses a process cost system to account for the production of three different products: M, L and C.

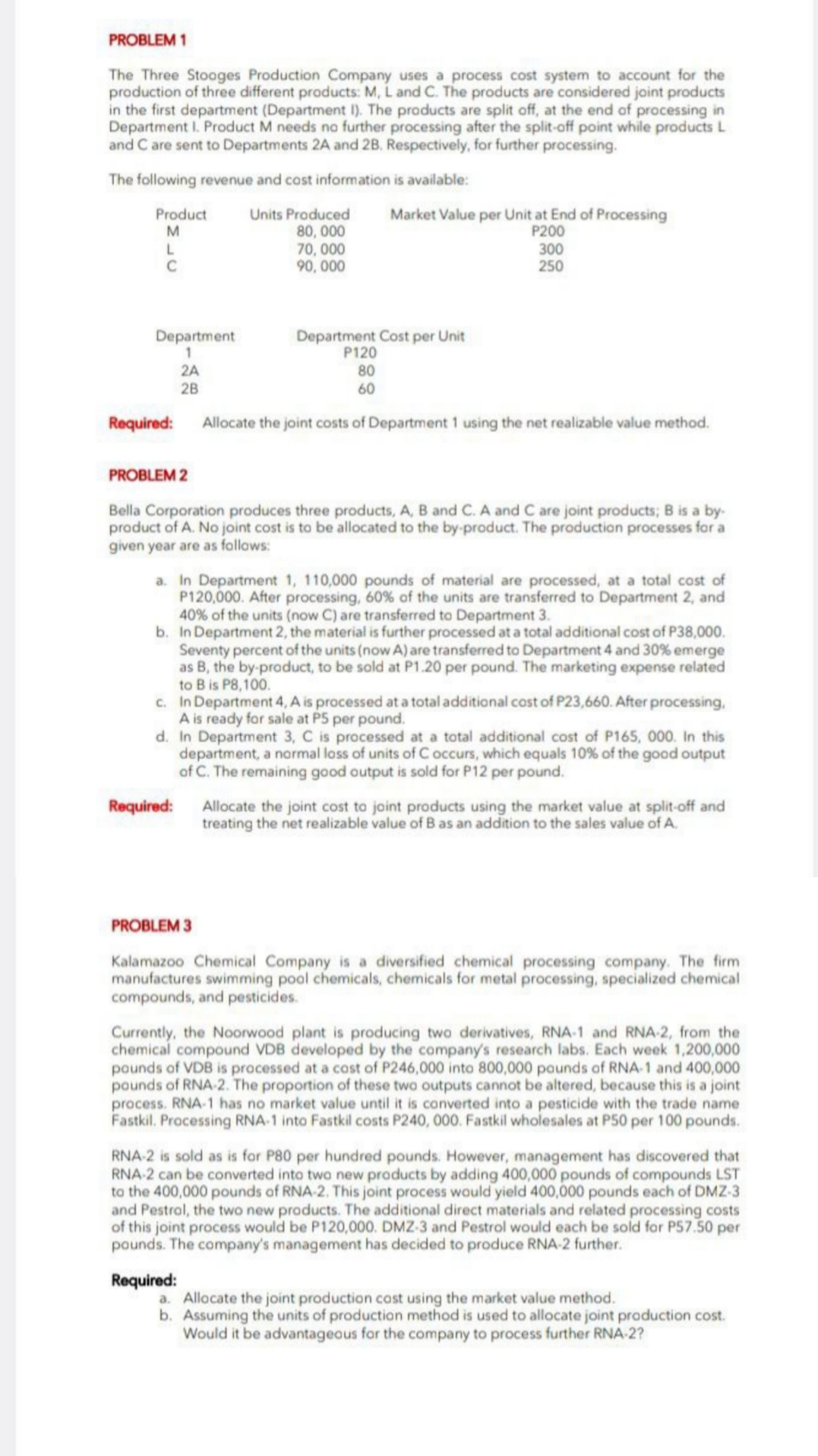

PROBLEM 1 The Three Stooges Production Company uses a process cost system to account for the production of three different products: M, L and C. The products are considered joint products in the first department (Department I). The products are split off, at the end of processing in Department I. Product M needs no further processing after the split-off point while products L and C are sent to Departments 2A and 2B. Respectively, for further processing. The following revenue and cost information is available: Product Units Produced Market Value per Unit at End of Processing M 80, 000 P200 70, 000 300 C 90, 000 250 Department Department Cost per Unit P120 2A 80 2B 60 Required: Allocate the joint costs of Department 1 using the net realizable value method. PROBLEM 2 Bella Corporation produces three products, A, B and C. A and C are joint products; B is a by. product of A. No joint cost is to be allocated to the by-product. The production processes for a given year are as follows: a. In Department 1, 110,000 pounds of material are processed, at a total cost of P120,000. After processing, 60% of the units are transferred to Department 2, and 40% of the units (now C) are transferred to Department 3. b. In Department 2, the material is further processed at a total additional cost of P38,000. Seventy percent of the units (now A) are transferred to Department 4 and 30% emerge as B, the by-product, to be sold at P1.20 per pound. The marketing expense related to B is P8, 100. C. In Department 4, A is processed at a total additional cost of P23,660. After processing. A is ready for sale at P5 per pound. d. In Department 3, C is processed at a total additional cost of P165, 000. In this department, a normal loss of units of C occurs, which equals 10% of the good output of C. The remaining good output is sold for P12 per pound. Required: Allocate the joint cost to joint products using the market value at split-off and treating the net realizable value of B as an addition to the sales value of A. PROBLEM 3 Kalamazoo Chemical Company is a diversified chemical processing company. The firm manufactures swimming pool chemicals, chemicals for metal processing, specialized chemical compounds, and pesticides. Currently, the Noorwood plant is producing two derivatives, RNA-1 and RNA-2, from the chemical compound VDB developed by the company's research labs. Each week 1,200,000 pounds of VDB is processed at a cost of P246,000 into 800,000 pounds of RNA-1 and 400,000 pounds of RNA-2. The proportion of these two outputs cannot be altered, because this is a joint process. RNA-1 has no market value until it is converted into a pesticide with the trade name Fastkil. Processing RNA-1 into Fastkil costs P240, 000. Fastkil wholesales at P50 per 100 pounds. RNA-2 is sold as is for P80 per hundred pounds. However, management has discovered that RNA-2 can be converted into two new products by adding 400,000 pounds of compounds LST to the 400,000 pounds of RNA-2. This joint process would yield 400,000 pounds each of DMZ-3 and Pestrol, the two new products. The additional direct materials and related processing costs of this joint process would be P120,000. DMZ-3 and Pestrol would each be sold for P57.50 per pounds. The company's management has decided to produce RNA-2 further. Required: a. Allocate the joint production cost using the market value method. b. Assuming the units of production method is used to allocate joint production cost. Would it be advantageous for the company to process further RNA-2