Question: Problem #1 This problem draws extensively from Section 6 of Lecture Notes (Asset Allocation). You have identified the Optimal Risky Portfolio (ORP) and have estimated

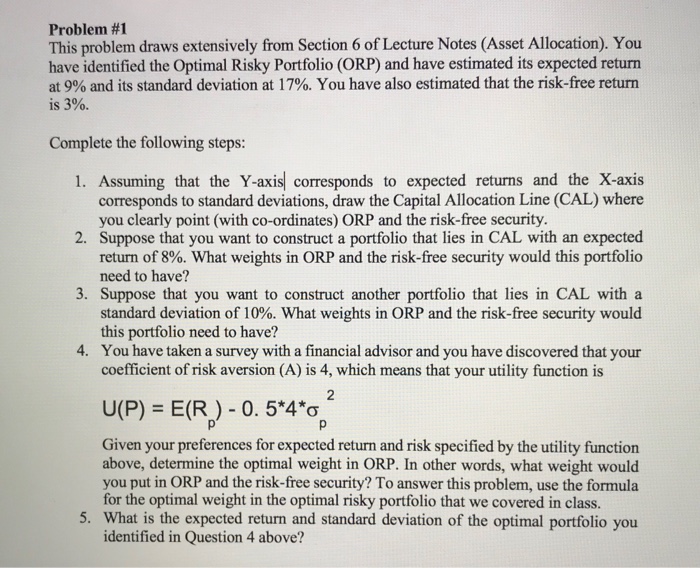

Problem #1 This problem draws extensively from Section 6 of Lecture Notes (Asset Allocation). You have identified the Optimal Risky Portfolio (ORP) and have estimated its expected return at 9% and its standard deviation at 17%. You have also estimated that the risk-free return is 3%. Complete the following steps: 1. Assuming that the Y-axis corresponds to expected returns and the X-axis 2. Suppose that you want to construct a portfolio that lies in CAL with an expected 3. Suppose that you want to construct another portfolio that lies in CAL with a 4. You have taken a survey with a financial advisor and you have discovered that your corresponds to standard deviations, draw the Capital Allocation Line (CAL) where you clearly point (with co-ordinates) ORP and the risk-free security return of 8%. What weights in ORP and the risk-free security would this portfolio need to have? standard deviation of 10%. What weights in ORP and the risk-free security would this portfolio need to have? coefficient of risk aversion (A) is 4, which means that your utility function is UP)-ER)-0. 54' Given your preferences for expected return and risk specified by the utility function above, determine the optimal weight in ORP. In other words, what weight would you put in ORP and the risk-free security? To answer this problem, use the formula for the optimal weight in the optimal risky portfolio that we covered in class. 5. What is the expected return and standard deviation of the optimal portfolio you identified in Question 4 above? Problem #1 This problem draws extensively from Section 6 of Lecture Notes (Asset Allocation). You have identified the Optimal Risky Portfolio (ORP) and have estimated its expected return at 9% and its standard deviation at 17%. You have also estimated that the risk-free return is 3%. Complete the following steps: 1. Assuming that the Y-axis corresponds to expected returns and the X-axis 2. Suppose that you want to construct a portfolio that lies in CAL with an expected 3. Suppose that you want to construct another portfolio that lies in CAL with a 4. You have taken a survey with a financial advisor and you have discovered that your corresponds to standard deviations, draw the Capital Allocation Line (CAL) where you clearly point (with co-ordinates) ORP and the risk-free security return of 8%. What weights in ORP and the risk-free security would this portfolio need to have? standard deviation of 10%. What weights in ORP and the risk-free security would this portfolio need to have? coefficient of risk aversion (A) is 4, which means that your utility function is UP)-ER)-0. 54' Given your preferences for expected return and risk specified by the utility function above, determine the optimal weight in ORP. In other words, what weight would you put in ORP and the risk-free security? To answer this problem, use the formula for the optimal weight in the optimal risky portfolio that we covered in class. 5. What is the expected return and standard deviation of the optimal portfolio you identified in Question 4 above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts