Question: Problem 1: Trigger Swap (25 Points) 3.125 Per Question A US firm has an outstanding loan from an Angel Investor. The firm will receive 1M

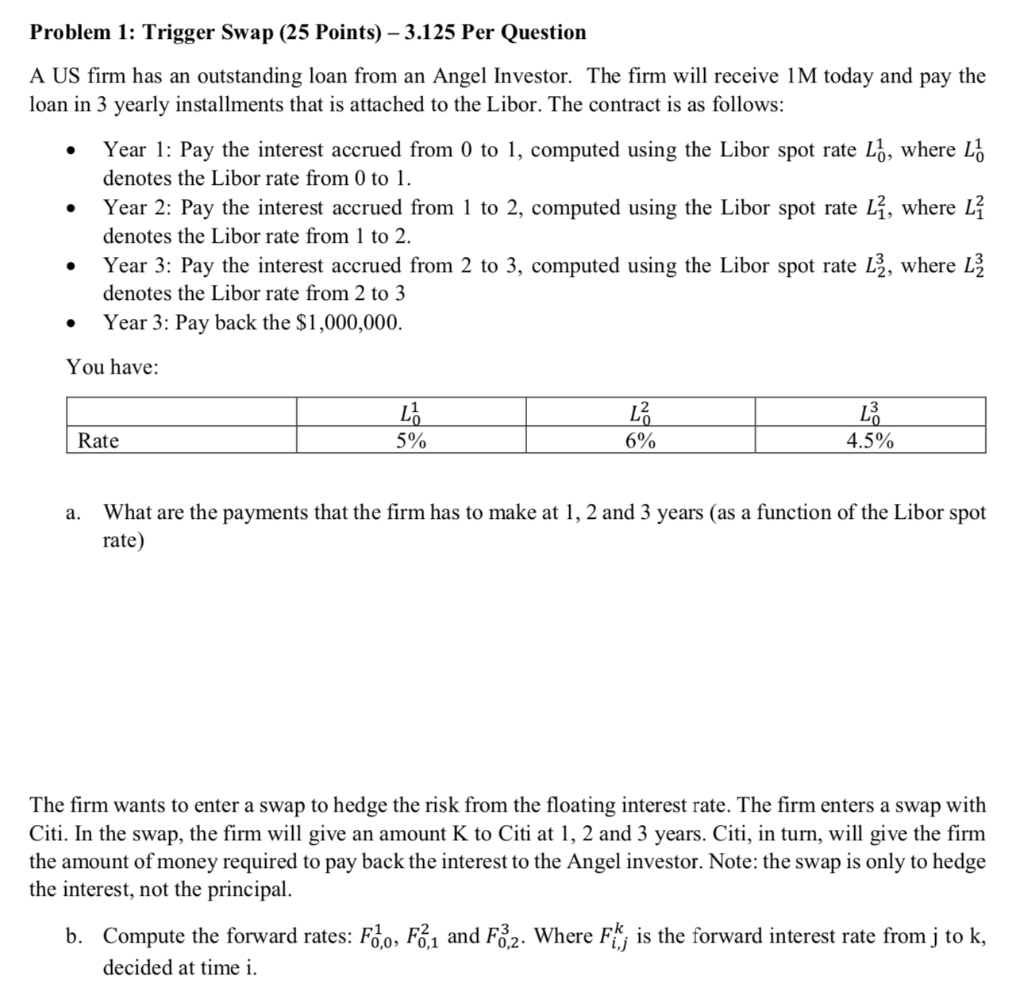

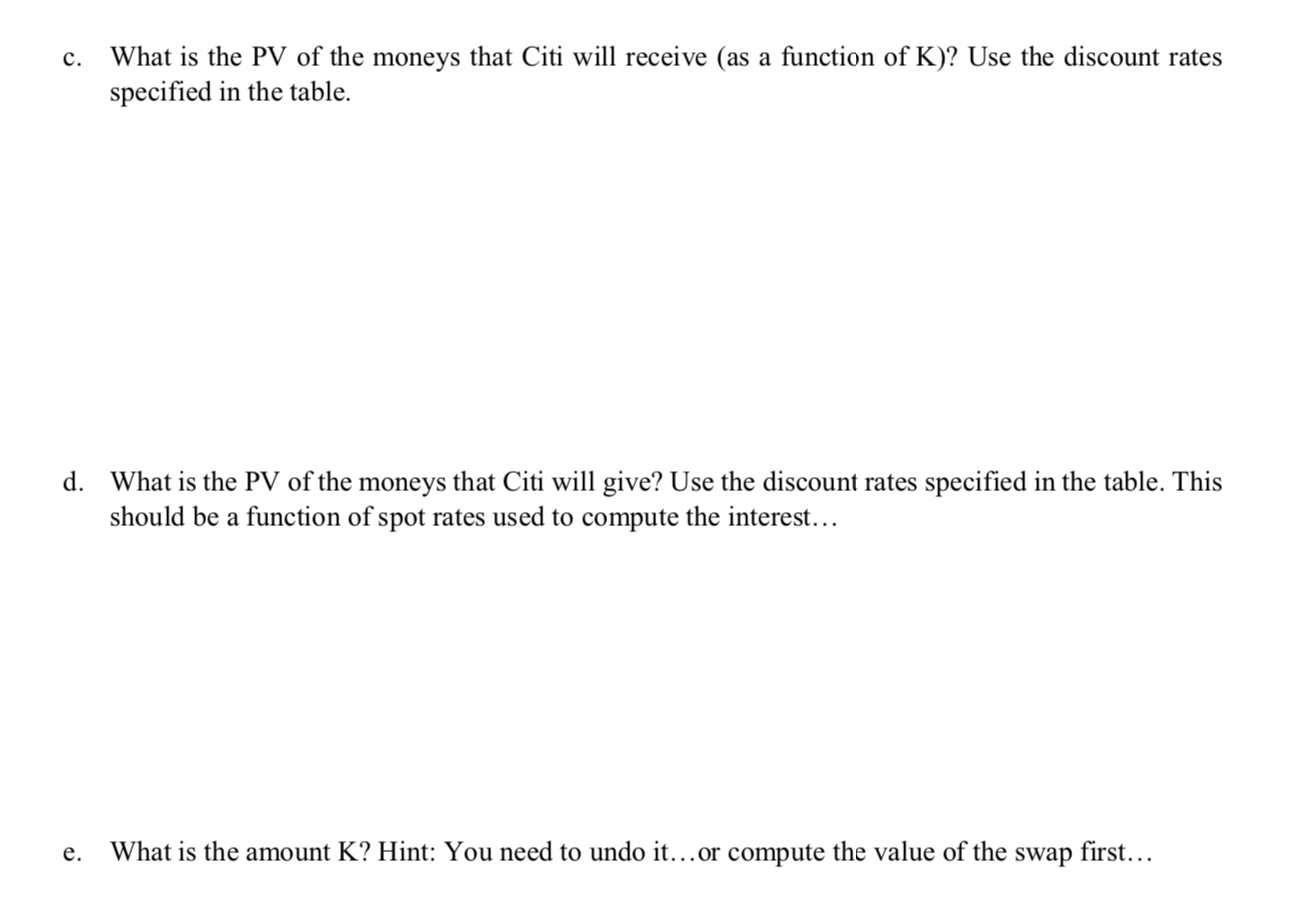

Problem 1: Trigger Swap (25 Points) 3.125 Per Question A US firm has an outstanding loan from an Angel Investor. The firm will receive 1M today and pay the loan in 3 yearly installments that is attached to the Libor. The contract is as follows: Year 1: Pay the interest accrued from 0 to 1, computed using the Libor spot rate L), where L denotes the Libor rate from 0 to 1. Year 2: Pay the interest accrued from 1 to 2, computed using the Libor spot rate L, where L denotes the Libor rate from 1 to 2. Year 3: Pay the interest accrued from 2 to 3, computed using the Libor spot rate L, where LZ denotes the Libor rate from 2 to 3 Year 3: Pay back the $1,000,000. You have: Lb 5% L2 6% L 4.5% Rate a. What are the payments that the firm has to make at 1, 2 and 3 years (as a function of the Libor spot rate) The firm wants to enter a swap to hedge the risk from the floating interest rate. The firm enters a swap with Citi. In the swap, the firm will give an amount K to Citi at 1, 2 and 3 years. Citi, in turn, will give the firm the amount of money required to pay back the interest to the Angel investor. Note: the swap is only to hedge the interest, not the principal. b. Compute the forward rates: F,0, F.,1 and F3.2. Where Fk; is the forward interest rate from j to k, decided at time i. c. What is the PV of the moneys that Citi will receive (as a function of K)? Use the discount rates specified in the table. d. What is the PV of the moneys that Citi will give? Use the discount rates specified in the table. This should be a function of spot rates used to compute the interest... e. What is the amount K? Hint: You need to undo it...or compute the value of the swap first... A trigger swap is a swap that is cancelled if a condition (pre-established) is met. If the condition is met, the swap is cancelled and no more exchange of cash flows occurs. If the condition is not met, the swap continues as normal. f. When would Citi like to include a "trigger condition to cancel the swap? Trying to hedge against large movements in the Libor, Citi now offers the firm a trigger swap. In the trigger swap, the swap is cancelled at t=3 years if the Libor spot rate crosses a threshold. Suppose that this occurs with 60% probability. As before, in the swap, the firm will give K to the bank and Citi will give the amount of interest required to the firm. What is the PV of the moneys that Citi will give? That Citi will receive? g. h. Compute K in this case. Problem 1: Trigger Swap (25 Points) 3.125 Per Question A US firm has an outstanding loan from an Angel Investor. The firm will receive 1M today and pay the loan in 3 yearly installments that is attached to the Libor. The contract is as follows: Year 1: Pay the interest accrued from 0 to 1, computed using the Libor spot rate L), where L denotes the Libor rate from 0 to 1. Year 2: Pay the interest accrued from 1 to 2, computed using the Libor spot rate L, where L denotes the Libor rate from 1 to 2. Year 3: Pay the interest accrued from 2 to 3, computed using the Libor spot rate L, where LZ denotes the Libor rate from 2 to 3 Year 3: Pay back the $1,000,000. You have: Lb 5% L2 6% L 4.5% Rate a. What are the payments that the firm has to make at 1, 2 and 3 years (as a function of the Libor spot rate) The firm wants to enter a swap to hedge the risk from the floating interest rate. The firm enters a swap with Citi. In the swap, the firm will give an amount K to Citi at 1, 2 and 3 years. Citi, in turn, will give the firm the amount of money required to pay back the interest to the Angel investor. Note: the swap is only to hedge the interest, not the principal. b. Compute the forward rates: F,0, F.,1 and F3.2. Where Fk; is the forward interest rate from j to k, decided at time i. c. What is the PV of the moneys that Citi will receive (as a function of K)? Use the discount rates specified in the table. d. What is the PV of the moneys that Citi will give? Use the discount rates specified in the table. This should be a function of spot rates used to compute the interest... e. What is the amount K? Hint: You need to undo it...or compute the value of the swap first... A trigger swap is a swap that is cancelled if a condition (pre-established) is met. If the condition is met, the swap is cancelled and no more exchange of cash flows occurs. If the condition is not met, the swap continues as normal. f. When would Citi like to include a "trigger condition to cancel the swap? Trying to hedge against large movements in the Libor, Citi now offers the firm a trigger swap. In the trigger swap, the swap is cancelled at t=3 years if the Libor spot rate crosses a threshold. Suppose that this occurs with 60% probability. As before, in the swap, the firm will give K to the bank and Citi will give the amount of interest required to the firm. What is the PV of the moneys that Citi will give? That Citi will receive? g. h. Compute K in this case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts