Question: PROBLEM 1: TRUE OR FALSE 1. A joint arrangement is accounted for under PFRS 11 only if all the parties have joint control over the

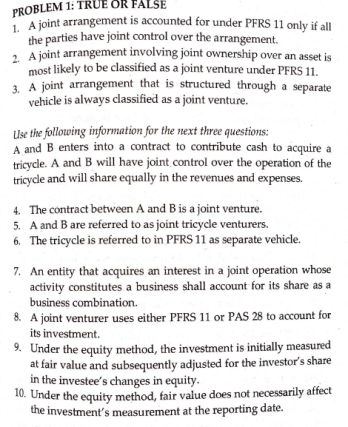

PROBLEM 1: TRUE OR FALSE 1. A joint arrangement is accounted for under PFRS 11 only if all the parties have joint control over the arrangement. 2. A joint arrangement involving joint ownership over an asset is most likely to be classified as a joint venture under PFRS 11. 3. A joint arrangement that is structured through a separate vehicle is always classified as a joint venture. Use tire following information for the next three questions: A and B enters into a contract to contribute cash to acquire a tricycle. A and B will have joint control over the operation of the tricycle and will share equally in the revenues and expenses. 4. The contract between A and B is a joint venture. 5. A and B are referred to as joint tricycle venturers. 6. The tricycle is referred to in PFRS 11 as separate vehicle. 7. An entity that acquires an interest in a joint operation whose activity constitutes a business shall account for its share as a business combination 8. A joint venturer uses either PFRS 11 or PAS 28 to account for its investment. 9. Under the equity method, the investment is initially measured at fair value and subsequently adjusted for the investor's share in the investee's changes in equity. 10. Under the equity method, fair value does not necessarily affect the investment's measurement at the reporting date

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts