Question: Problem 1: Use the company's financial data to answer the questions. Vortex IT Company: Balance Sheet as of December 31, 2017 (In Thousands) Cash $77,500

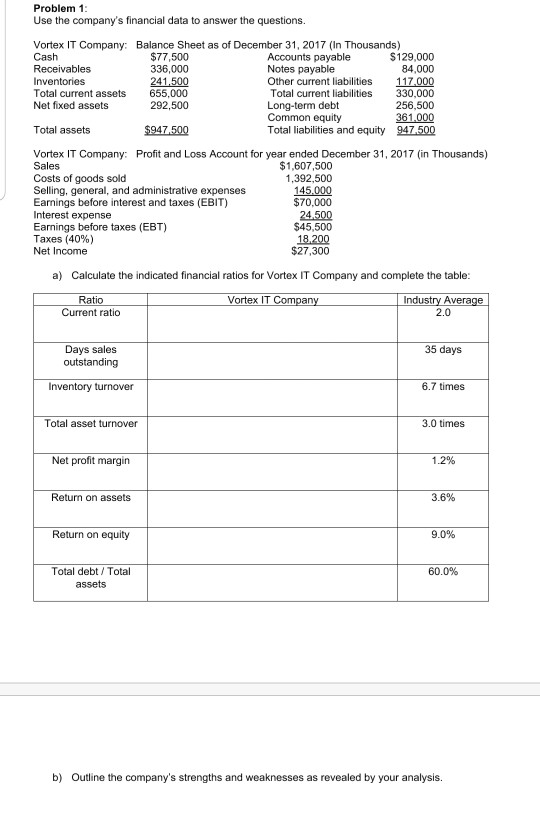

Problem 1: Use the company's financial data to answer the questions. Vortex IT Company: Balance Sheet as of December 31, 2017 (In Thousands) Cash $77,500 Accounts payable $129,000 Receivables 336,000 Notes payable 84,000 Inventories 241.500 Other current liabilities 117.000 Total current assets 655.000 Total current liabilities 330,000 Net fixed assets 292,500 Long-term debt 256,500 Common equity 361,000 Total assets $947,500 Total liabilities and equity 947,500 Vortex IT Company Profit and Loss Account for year ended December 31, 2017 (in Thousands) Sales $1,607,500 Costs of goods sold 1,392,500 Selling, general, and administrative expenses 145,000 Earnings before interest and taxes (EBIT) $70,000 Interest expense 24,500 Earnings before taxes (EBT) $45,500 Taxes (40%) 18.200 Net Income $27,300 a) Calculate the indicated financial ratios for Vortex IT Company and complete the table: Ratio Vortex IT Company Industry Average Current ratio 2.0 35 days Days sales outstanding Inventory turnover 6.7 times Total asset turnover 3.0 times Net profit margin 1.2% Return on assets 3.6% Return on equity 9.0% 60.0% Total debt / Total assets b) Outline the company's strengths and weaknesses as revealed by your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts