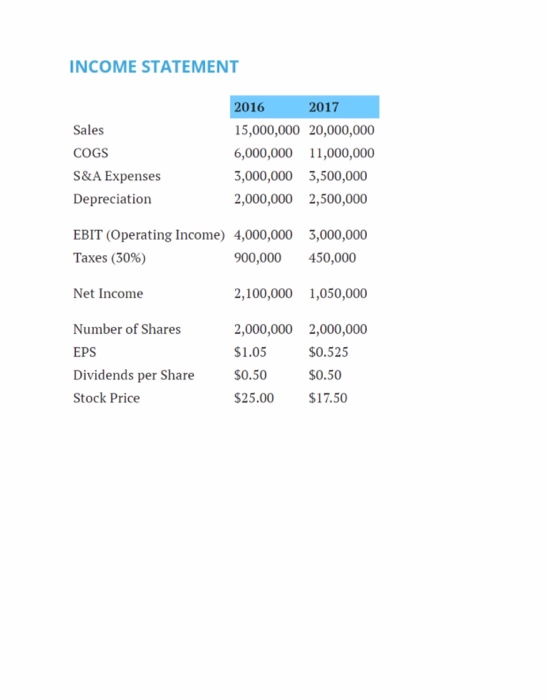

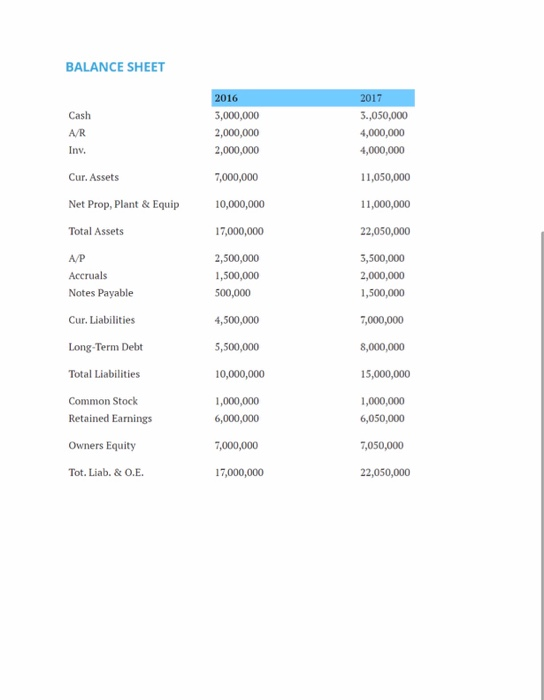

Question: Problem 1) Using the Financial Statements for Joe's Gadgets, find the following ratios for 2016 and 2017. 1a. Current ratio 1b. Quick ratio (Acid Test)

INCOME STATEMENT 2016 2017 Sales 15,000,000 20,000,000 COGS 6,000,000 11,000,000 S&A Expenses 3,000,000 3,500,000 Depreciation 2,000,000 2,500,000 EBIT (Operating Income) 4,000,000 3,000,000 Taxes (30%) 900,000 450,000 Net Income 2,100,000 1,050,000 Number of Shares EPS Dividends per Share Stock Price 2,000,000 2,000,000 $1.05 $0.525 $0.50 $0.50 $25.00 $17.50 BALANCE SHEET Cash AR Inv. 2017 3.,050,000 4,000,000 4,000,000 11,050,000 11,000,000 Cur. Assets Net Prop, Plant & Equip Total Assets A/P Accruals Notes Payable 2016 3,000,000 2,000,000 2,000,000 7,000,000 10,000,000 17,000,000 2,500,000 1,500,000 500,000 4,500,000 5,500,000 10,000,000 1,000,000 6,000,000 7,000,000 17,000,000 22,050,000 3,500,000 2,000,000 1,500,000 7,000,000 Cur. Liabilities Long-Term Debt Total Liabilities Common Stock Retained Earnings Owners Equity Tot. Liab. & C.E. 8,000,000 15,000,000 1,000,000 6,050,000 7,050,000 22,050,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts