Question: PROBLEM 1 (Weight 40% ): Activity-based costing in a manufacturing firm Alice , Inc . manufactures two models of faucets - a regular and a

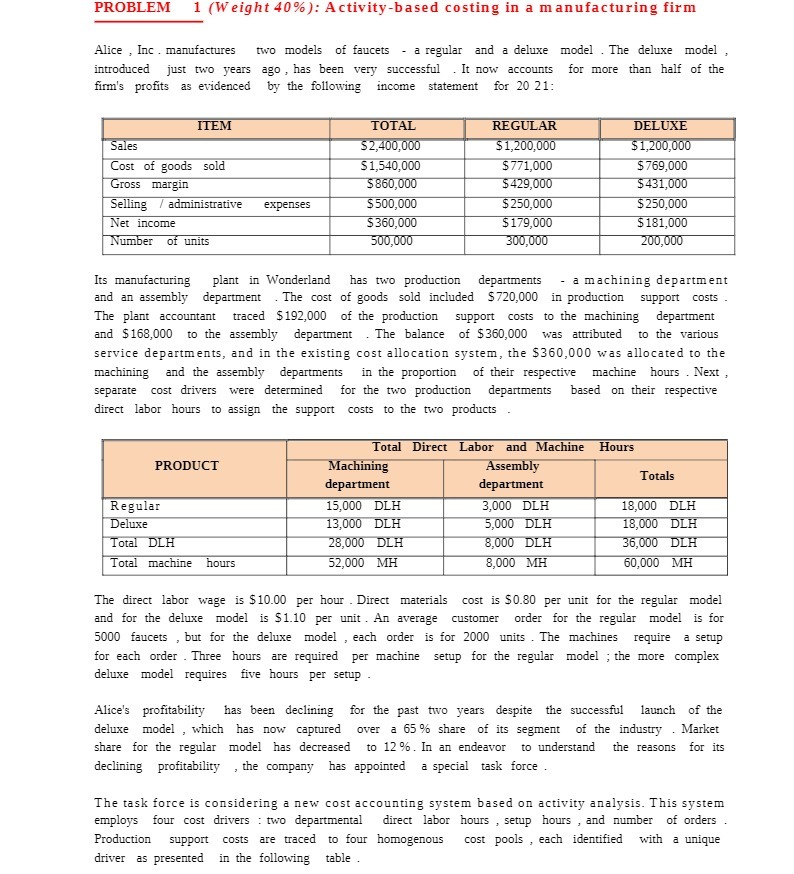

PROBLEM 1 (Weight 40% ): Activity-based costing in a manufacturing firm Alice , Inc . manufactures two models of faucets - a regular and a deluxe model . The deluxe model introduced just two years ago , has been very successful . It now accounts for more than half of the firm's profits as evidenced by the following income statement for 20 21: ITEM TOTAL REGULAR DELUXE Sales $2,400,000 $1,200,000 $ 1,200,000 Cost of goods sold $1,540,000 $ 771,000 $769,000 Gross margin 5860,000 $429,000 $431,000 Selling / administrative expenses $500,000 $ 250,000 $ 250,000 Net income $ 360,000 $ 179,000 $ 181,000 Number of units 500,000 300,000 200,000 Its manufacturing plant in Wonderland has two production departments - a machining department and an assembly department . The cost of goods sold included $720,000 in production support costs The plant accountant traced $192,000 of the production support costs to the machining department and $168,000 to the assembly department . The balance of $360,000 was attributed to the various service departments, and in the existing cost allocation system, the $360,000 was allocated to the machining and the assembly departments in the proportion of their respective machine hours . Next , separate cost drivers were determined for the two production departments based on their respective direct labor hours to assign the support costs to the two products Total Direct Labor and Machine Hours PRODUCT Machining Assembly Totals department department Regular 15,000 DLH 3,000 DLH 18,000 DLH Deluxe 13,000 DLH 5,000 DLH 18,000 DLH Total DLH 28,000 DLH 8,000 DLH 36,000 DLH Total machine hours 52,000 MH 8,000 MH 60,000 MH The direct labor wage is $10.00 per hour . Direct materials cost is $0.80 per unit for the regular model and for the deluxe model is $1.10 per unit . An average customer order for the regular model is for 5000 faucets , but for the deluxe model , each order is for 2000 units . The machines require a setup for each order . Three hours are required per machine setup for the regular model ; the more complex deluxe model requires five hours per setup Alice's profitability has been declining for the past two years despite the successful launch of the deluxe model , which has now captured over a 65 % share of its segment of the industry . Market share for the regular model has decreased to 12 96. In an endeavor to understand the reasons for its declining profitability , the company has appointed a special task force The task force is considering a new cost accounting system based on activity analysis. This system employs four cost drivers : two departmental direct labor hours , setup hours , and number of orders Production support costs are traced to four homogenous cost pools , each identified with a unique driver as presented in the following table