Question: Problem 1 (Weight 60%; each question weighted equally) After completing your degree in finance from NHH you land job as an analyst for FACTORfinance.

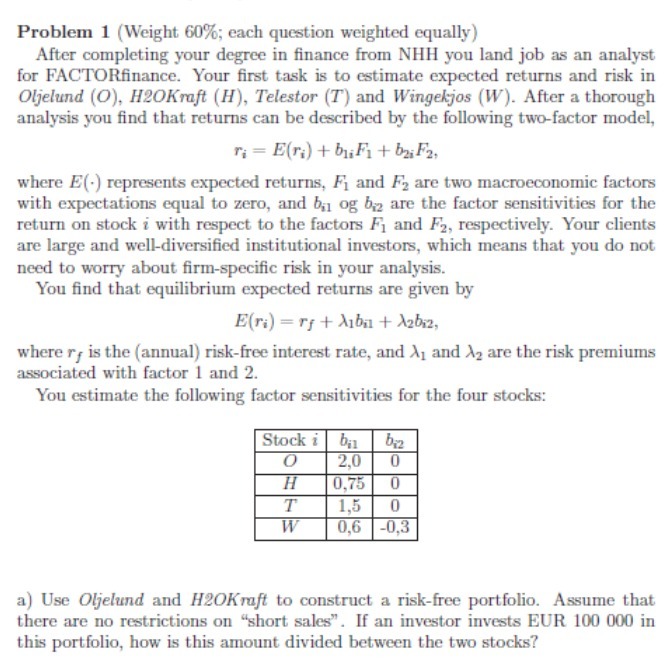

Problem 1 (Weight 60%; each question weighted equally) After completing your degree in finance from NHH you land job as an analyst for FACTORfinance. Your first task is to estimate expected returns and risk in Oljelund (O), H20Kraft (H), Telestor (T) and Wingekjos (W). After a thorough analysis you find that returns can be described by the following two-factor model, r=E(r)+bi Fi+bai F2, where E(-) represents expected returns, F and F are two macroeconomic factors with expectations equal to zero, and bi og b are the factor sensitivities for the return on stock i with respect to the factors F1 and F2, respectively. Your clients are large and well-diversified institutional investors, which means that you do not need to worry about firm-specific risk in your analysis. You find that equilibrium expected returns are given by E(ri) rf+Aiba + A2biz, where ry is the (annual) risk-free interest rate, and A1 and A2 are the risk premiums associated with factor 1 and 2. You estimate the following factor sensitivities for the four stocks: Stock i 0 bi b2 2,0 0 H 0,75 0 T 1,5 0 W 0,6 -0,3 a) Use Oljelund and H20Kraft to construct a risk-free portfolio. Assume that there are no restrictions on "short sales". If an investor invests EUR 100 000 in this portfolio, how is this amount divided between the two stocks?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts