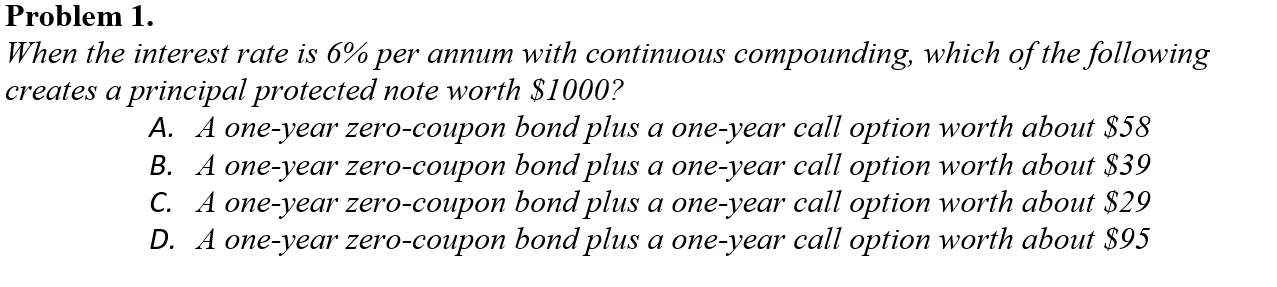

Question: Problem 1. When the interest rate is 6% per annum with continuous compounding, which of the following creates a principal protected note worth $1000?

Problem 1. When the interest rate is 6% per annum with continuous compounding, which of the following creates a principal protected note worth $1000? A. A one-year zero-coupon bond plus a one-year call option worth about $58 B. A one-year zero-coupon bond plus a one-year call option worth about $39 C. A one-year zero-coupon bond plus a one-year call option worth about $29 D. A one-year zero-coupon bond plus a one-year call option worth about $95

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to determine the cost of a oneyear zerocoupon bond at a 6 interest rat... View full answer

Get step-by-step solutions from verified subject matter experts