Question: Problem 1: You are asked to evaluate the common stock of Alcoa Corp (ticker symbol: AA) using the constant dividend growth model and the CAPM.

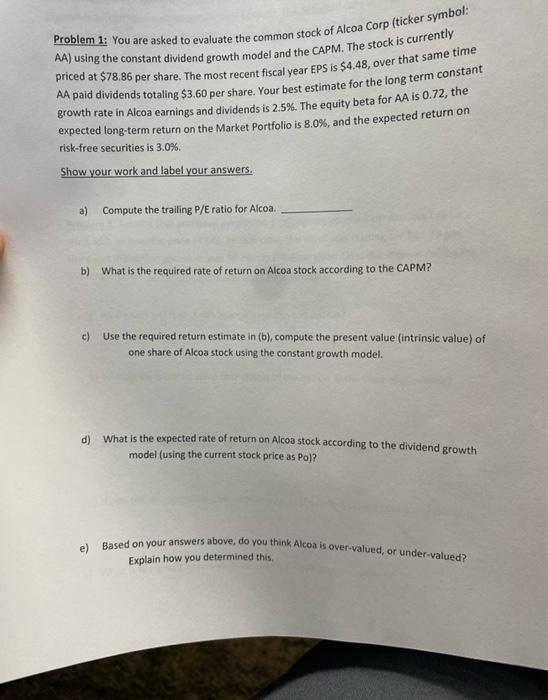

Problem 1: You are asked to evaluate the common stock of Alcoa Corp (ticker symbol: AA) using the constant dividend growth model and the CAPM. The stock is currently priced at $78.86 per share. The most recent fiscal year EPS is $4.48, over that same time AA paid dividends totaling $3.60 per share. Your best estimate for the long term constant growth rate in Alcoa earnings and dividends is 2.5%. The equity beta for AA is 0.72, the expected long-term return on the Market Portfolio is 8.0%, and the expected return on risk-free securities is 3.0%. Show your work and label your answers. a) Compute the trailing P/E ratio for Alcoa. b) What is the required rate of return on Alcoa stock according to the CAPM? c) Use the required return estimate in (b), compute the present value (intrinsic value) of one share of Alcoa stock using the constant growth model. d) What is the expected rate of return on Alcoa stock according to the dividend growth model (using the current stock price as Po)? e) Based on your answers above, do you think Alcoa is over-valued, or under valued? Explain how you determined this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts