Question: Problem 1. You were engaged for the first time to audit the Is of Bebeko Corporation for the period ended December 31, 2020. The company

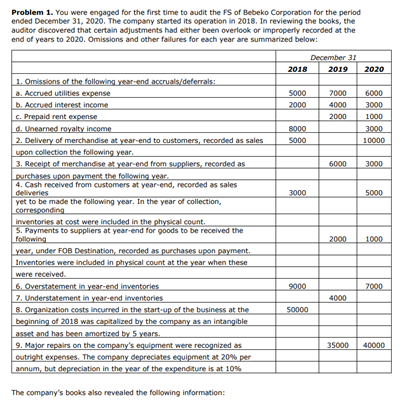

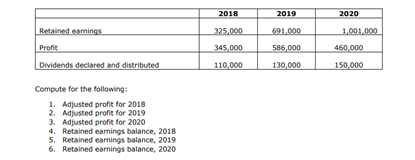

Problem 1. You were engaged for the first time to audit the Is of Bebeko Corporation for the period ended December 31, 2020. The company started its operation in 2018, In reviewing the books, the auditor discovered that certain adjustments had either been overlock or improperly recorded at the end of years to 2020. Omissions and other failures for each year are summarized below: December 31 2018 2019 2020 1. Omissions of the following year-end accruals/deferrals: D. Accrued utilities expense 5000 70 00 60 00 b. Accrued interest income 7000 40 00 3000 C. Prepaid rent expense 2000 1000 d. Unearned royalty income 8000 3000 2. Delivery of merchandise at year-end to customers, recorded as sales 5000 10000 upon collection the following year. 3. Receipt of merchandise at year-end from suppliers, recorded as 60 00 3000 purchasetipon payment the following your 4. Cash received from customers at year end, recorded as sales deliveries 3000 5000 yet to be made the following year. In the year of collection, come ponding InventoriesIn't cast were included in the physical count. S. Payments to suppliers at year-end for goods to be received the following 2000 1800 war, under FOR Destination, recorded as purchases upon payment, Inventories were included in physical count at the year when these were received 6. Overstatement In year-end Inventories 9000 7000 7, Understatement in year-end inventories 40 00 8. Organisation costs incurred in the start-up of the business at the beginning of 2018 was capitalized by the company as an intangible freeet and has been amortiand by 5 years. 9. Major repairs on the company's equipment were recognized as 35000 40000 outright expenses. The company depreciates equipment at 20% per minnum, but depreciation in the war of theexpend tur is at 10%% The company's books also revealed the following information:2018 2010 2020 Retained caminge 325 000 691,000 1,001,060 Profit 345,000 586.0 00 460 000 Dividends declared and distributed 110.000 130,0 00 150,000 Compute for the following: 1. Adjusted profit for 2018 2. Adjusted profit for 2019 3. Adjusted profit for 2020 4. Retained earnings balance, 2018 5, Retained earnings balance, 2019 6, Retained earnings balance, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts