Question: Problem #1. You wrote (sold short) 3 call options described in the above example and purchased some shares of the underlying stock to achieve delta

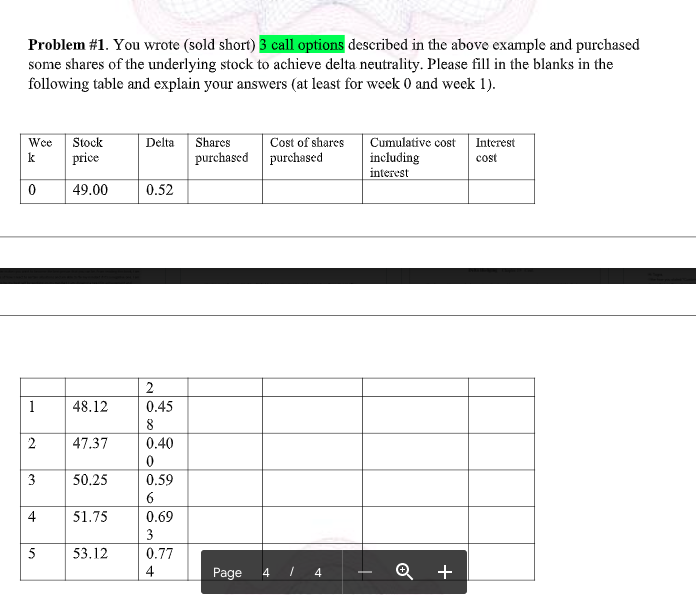

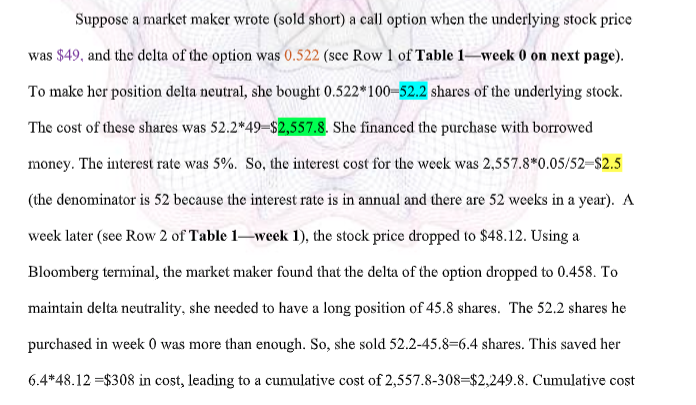

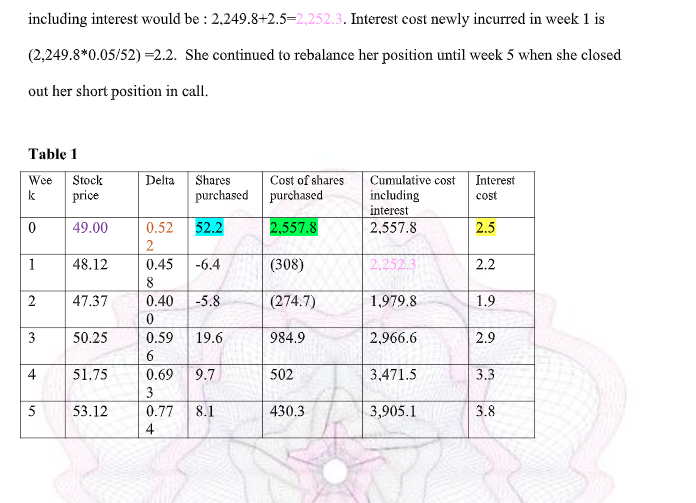

Problem #1. You wrote (sold short) 3 call options described in the above example and purchased some shares of the underlying stock to achieve delta neutrality. Please fill in the blanks in the following table and explain your answers (at least for week 0 and week 1). Wee k Delta Stock price Shares purchased Cost of shares purchased Cumulative cost including interest Interest cost 0 49.00 0.52 2 48.12 0.45 2 47.37 0.40 50.25 0.59 51.75 0.69 0.77 Page 4 / 4 - Q + Suppose a market maker wrote (sold short) a call option when the underlying stock price was $49, and the delta of the option was 0.522 (sce Row 1 of Table 1-week 0 on next page). To make her position delta neutral, she bought 0.522*10052.2 shares of the underlying stock. The cost of these shares was 52.2*49$2,557.8. She financed the purchase with borrowed money. The interest rate was 5%. So, the interest cost for the week was 2,557.8*0.05/52-$2.5 (the denominator is 52 because the interest rate is in annual and there are 52 weeks in a year). A week later (see Row 2 of Table 1week 1), the stock price dropped to $48.12. Using a Bloomberg terminal, the market maker found that the delta of the option dropped to 0.458. To maintain delta neutrality, she needed to have a long position of 45.8 shares. The 52.2 shares he purchased in week 0 was more than enough. So, she sold 52.2-45.8=6.4 shares. This saved her 6.4*48.12 =$308 in cost, leading to a cumulative cost of 2,557.8-308=$2,249.8. Cumulative cost including interest would be : 2.249.8+2.5=2,252.3. Interest cost newly incurred in week 1 is (2,249.8*0.05/52) =2.2. She continued to rebalance her position until week 5 when she closed out her short position in call. Table 1 Wee Delta Stock price Shares purchased Cost of shares purchased Interest cost Cumulative cost including interest 2,557.8 0 49.00 0.52 52.2 2,557.8 2.5 48.12 0.45 -6.4 (308) 2.25213 47.37 0.40 -5.8 (274.7) 1,979.8 1.9 50.25 0.59 19.6 984.9 2,966.6 12.9 51.75 0.69 9.7 502 3,471.5 53.12 0.77 8.1 430.3 3,905.1 Problem #1. You wrote (sold short) 3 call options described in the above example and purchased some shares of the underlying stock to achieve delta neutrality. Please fill in the blanks in the following table and explain your answers (at least for week 0 and week 1). Wee k Delta Stock price Shares purchased Cost of shares purchased Cumulative cost including interest Interest cost 0 49.00 0.52 2 48.12 0.45 2 47.37 0.40 50.25 0.59 51.75 0.69 0.77 Page 4 / 4 - Q + Suppose a market maker wrote (sold short) a call option when the underlying stock price was $49, and the delta of the option was 0.522 (sce Row 1 of Table 1-week 0 on next page). To make her position delta neutral, she bought 0.522*10052.2 shares of the underlying stock. The cost of these shares was 52.2*49$2,557.8. She financed the purchase with borrowed money. The interest rate was 5%. So, the interest cost for the week was 2,557.8*0.05/52-$2.5 (the denominator is 52 because the interest rate is in annual and there are 52 weeks in a year). A week later (see Row 2 of Table 1week 1), the stock price dropped to $48.12. Using a Bloomberg terminal, the market maker found that the delta of the option dropped to 0.458. To maintain delta neutrality, she needed to have a long position of 45.8 shares. The 52.2 shares he purchased in week 0 was more than enough. So, she sold 52.2-45.8=6.4 shares. This saved her 6.4*48.12 =$308 in cost, leading to a cumulative cost of 2,557.8-308=$2,249.8. Cumulative cost including interest would be : 2.249.8+2.5=2,252.3. Interest cost newly incurred in week 1 is (2,249.8*0.05/52) =2.2. She continued to rebalance her position until week 5 when she closed out her short position in call. Table 1 Wee Delta Stock price Shares purchased Cost of shares purchased Interest cost Cumulative cost including interest 2,557.8 0 49.00 0.52 52.2 2,557.8 2.5 48.12 0.45 -6.4 (308) 2.25213 47.37 0.40 -5.8 (274.7) 1,979.8 1.9 50.25 0.59 19.6 984.9 2,966.6 12.9 51.75 0.69 9.7 502 3,471.5 53.12 0.77 8.1 430.3 3,905.1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts