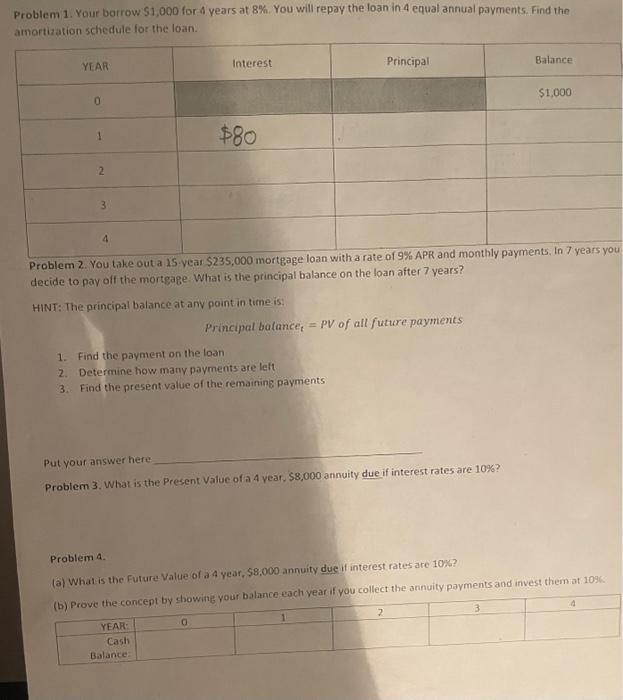

Question: Problem 1. Your borrow $1,000 for 4 years at 8%. You will repay the loan in 4 equal annual payments. Find the amortization schedule for

Problem 1. Your borrow 51,000 for 4 vears at 8%. You will repay the loan in 4 equal annual payments. Find the amortization schedule for the Ioan. decide to pay off the mortgage. What is the principal balance on the loan after 7 vears? HINT: The principal balance at any point in time is: Principalbatance,=PVofallfuturepayments 1. Find the payment on the loan 2. Determine how many payments are lett 3. Find the present value of the remaining payments Put your answer here Problem 3. What is the Present Value of a 4 year, $8,000 annuity due if interest rates are 10% ? Problem 4. (a) What is the future Value of a 4 year, $8,000 annuity due if interest rates are 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts