Question: Problem 10. (10 points total) Suppose that you believe in APT and that there are two factors that matter in pricing an asset: inflation (I)

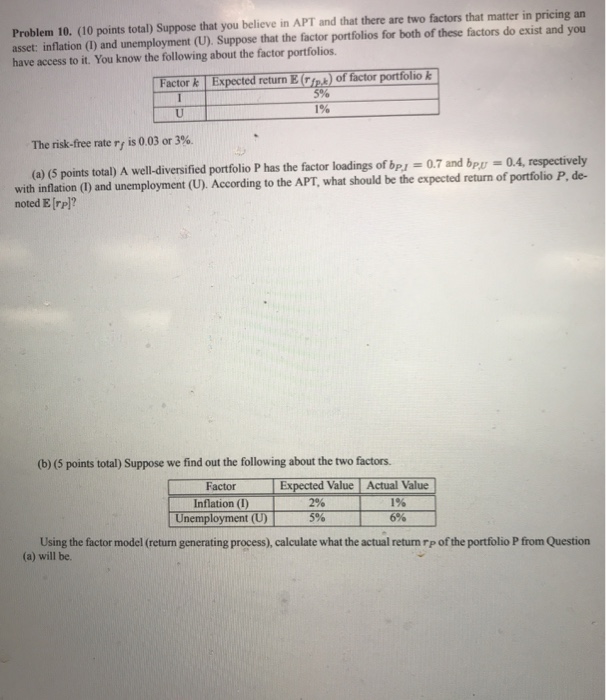

Problem 10. (10 points total) Suppose that you believe in APT and that there are two factors that matter in pricing an asset: inflation (I) and unemployment (U). Suppose that the factor portfolios for both of these factors do exist and you have access to it. You know the following about the factor portfolios. Factor kExpected return Eie) of factor portiolio 5% 1% The risk-free rate ry is 003 or 396. (a) (S points total) A well-diversified portfolio P has the factor loadings of b0.7 and b-0.4 with inflation (1) and unemployment (U). According to the APT, what should be the expected return of portfolio P, de- noted E [rpl? (b) (5 points total) Suppose we find out the following about the two factors. Factor xpected Value Actual Value Inflation (I) Unemployment (U) 2% 5% 1% 6% Using the factor model (return generating process), calculate what the actual return rp of the portfolio P from Question (a) will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts