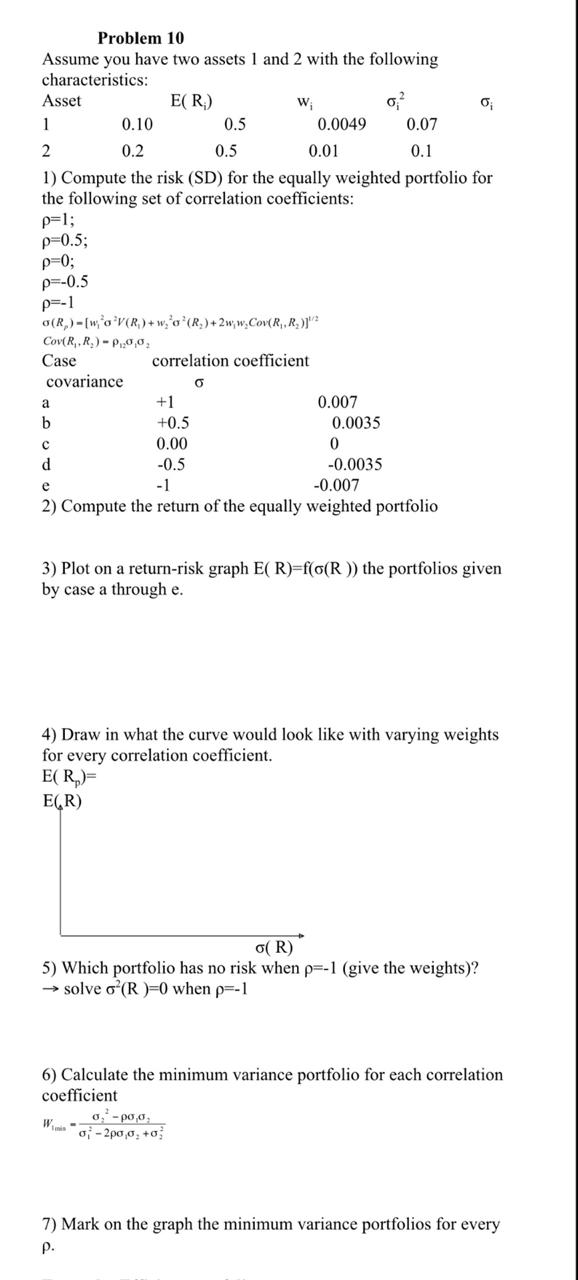

Question: Problem 10 Assume you have two assets 1 and 2 with the following characteristics: Asset E(R) w 0 0 0.10 0.5 0.0049 0.07 2 0.2

Problem 10 Assume you have two assets 1 and 2 with the following characteristics: Asset E(R) w 0 0 0.10 0.5 0.0049 0.07 2 0.2 0.5 0.01 0.1 1) Compute the risk (SD) for the equally weighted portfolio for the following set of correlation coefficients: p=1; p=0.5; p=0; p=-0.5 p=1 O(R)-[w; *V(R.) +w, 'a'(R.)+2ww.Cov(R., R.))"? Cove R., R)-.0.0, Case correlation coefficient covariance +1 0.007 +0.5 0.0035 0.00 -0.5 -0.0035 -0.007 2) Compute the return of the equally weighted portfolio 3) Plot on a return-risk graph E(R)=f(O(R)) the portfolios given by case a through e. 4) Draw in what the curve would look like with varying weights for every correlation coefficient. E(R) E(R) O(R) 5) Which portfolio has no risk when p=-1 (give the weights)? solve o(R)=0 when p=-1 6) Calculate the minimum variance portfolio for each correlation coefficient 0 -poo. 0-2p0,0, +0 W 7) Mark on the graph the minimum variance portfolios for every Problem 10 Assume you have two assets 1 and 2 with the following characteristics: Asset E(R) w 0 0 0.10 0.5 0.0049 0.07 2 0.2 0.5 0.01 0.1 1) Compute the risk (SD) for the equally weighted portfolio for the following set of correlation coefficients: p=1; p=0.5; p=0; p=-0.5 p=1 O(R)-[w; *V(R.) +w, 'a'(R.)+2ww.Cov(R., R.))"? Cove R., R)-.0.0, Case correlation coefficient covariance +1 0.007 +0.5 0.0035 0.00 -0.5 -0.0035 -0.007 2) Compute the return of the equally weighted portfolio 3) Plot on a return-risk graph E(R)=f(O(R)) the portfolios given by case a through e. 4) Draw in what the curve would look like with varying weights for every correlation coefficient. E(R) E(R) O(R) 5) Which portfolio has no risk when p=-1 (give the weights)? solve o(R)=0 when p=-1 6) Calculate the minimum variance portfolio for each correlation coefficient 0 -poo. 0-2p0,0, +0 W 7) Mark on the graph the minimum variance portfolios for every

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts