Question: Problem 10 Based on a sample of firm-level monthly data for 2000:01 to 2019:12 for stock returns and log stock prices, the time series of

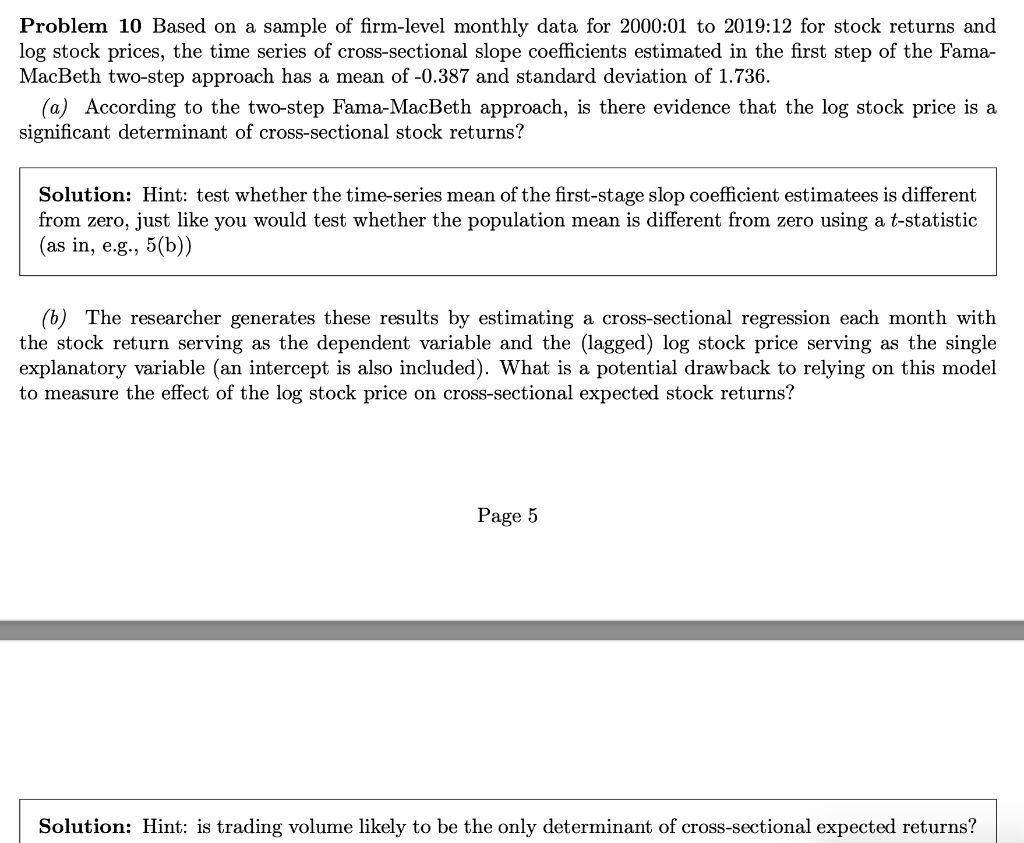

Problem 10 Based on a sample of firm-level monthly data for 2000:01 to 2019:12 for stock returns and log stock prices, the time series of cross-sectional slope coefficients estimated in the first step of the Fama- MacBeth two-step approach has a mean of -0.387 and standard deviation of 1.736. (a) According to the two-step Fama-MacBeth approach, is there evidence that the log stock price is a significant determinant of cross-sectional stock returns? Solution: Hint: test whether the time-series mean of the first stage slop coefficient estimatees is different from zero, just like you would test whether the population mean is different from zero using a t-statistic (as in, e.g., 5(b)) (6) The researcher generates these results by estimating a cross-sectional regression each month with the stock return serving as the dependent variable and the (lagged) log stock price serving as the single explanatory variable (an intercept is also included). What is a potential drawback to relying on this model to measure the effect of the log stock price on cross-sectional expected stock returns? Page 5 Solution: Hint: is trading volume likely to be the only determinant of cross-sectional expected returns? Problem 10 Based on a sample of firm-level monthly data for 2000:01 to 2019:12 for stock returns and log stock prices, the time series of cross-sectional slope coefficients estimated in the first step of the Fama- MacBeth two-step approach has a mean of -0.387 and standard deviation of 1.736. (a) According to the two-step Fama-MacBeth approach, is there evidence that the log stock price is a significant determinant of cross-sectional stock returns? Solution: Hint: test whether the time-series mean of the first stage slop coefficient estimatees is different from zero, just like you would test whether the population mean is different from zero using a t-statistic (as in, e.g., 5(b)) (6) The researcher generates these results by estimating a cross-sectional regression each month with the stock return serving as the dependent variable and the (lagged) log stock price serving as the single explanatory variable (an intercept is also included). What is a potential drawback to relying on this model to measure the effect of the log stock price on cross-sectional expected stock returns? Page 5 Solution: Hint: is trading volume likely to be the only determinant of cross-sectional expected returns

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts