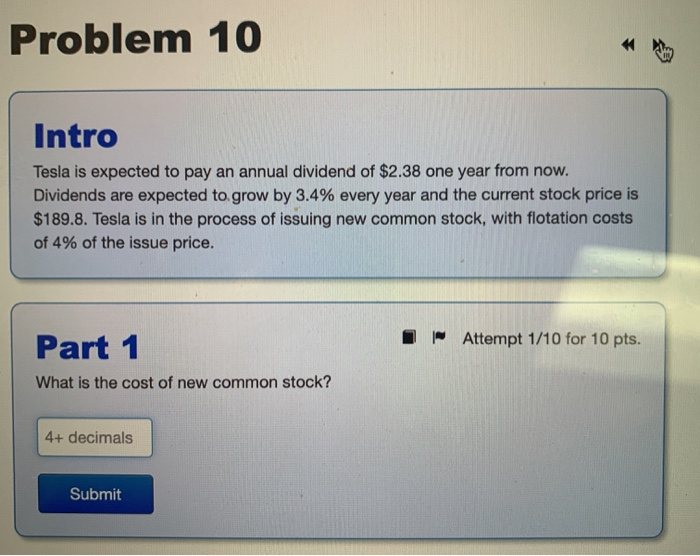

Question: Problem 10 Intro Tesla is expected to pay an annual dividend of $2.38 one year from now. Dividends are expected to grow by 3.4% every

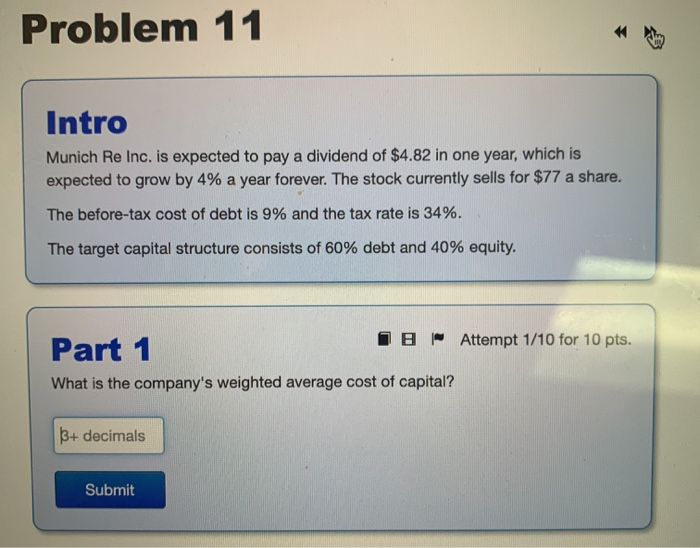

Problem 10 Intro Tesla is expected to pay an annual dividend of $2.38 one year from now. Dividends are expected to grow by 3.4% every year and the current stock price is $189.8. Tesla is in the process of issuing new common stock, with flotation costs of 4% of the issue price. I| Attempt 1/10 for 10 pts. Part 1 What is the cost of new common stock? 4+ decimals Submit Problem 11 Intro Munich Re Inc. is expected to pay a dividend of $4.82 in one year, which is expected to grow by 4% a year forever. The stock currently sells for $77 a share. The before-tax cost of debt is 9% and the tax rate is 34%. The target capital structure consists of 60% debt and 40% equity. Part 1 IB Attempt 1/10 for 10 pts. What is the company's weighted average cost of capital? B+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts