Question: PROBLEM 10-1. Master Budget [LO 2] (Note: This problem is similar to Review Problem 2, only the numbers have been changed. Students who get stuck

![PROBLEM 10-1. Master Budget [LO 2] (Note: This problem is similar](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f7bfcd749f5_52466f7bfcce784c.jpg)

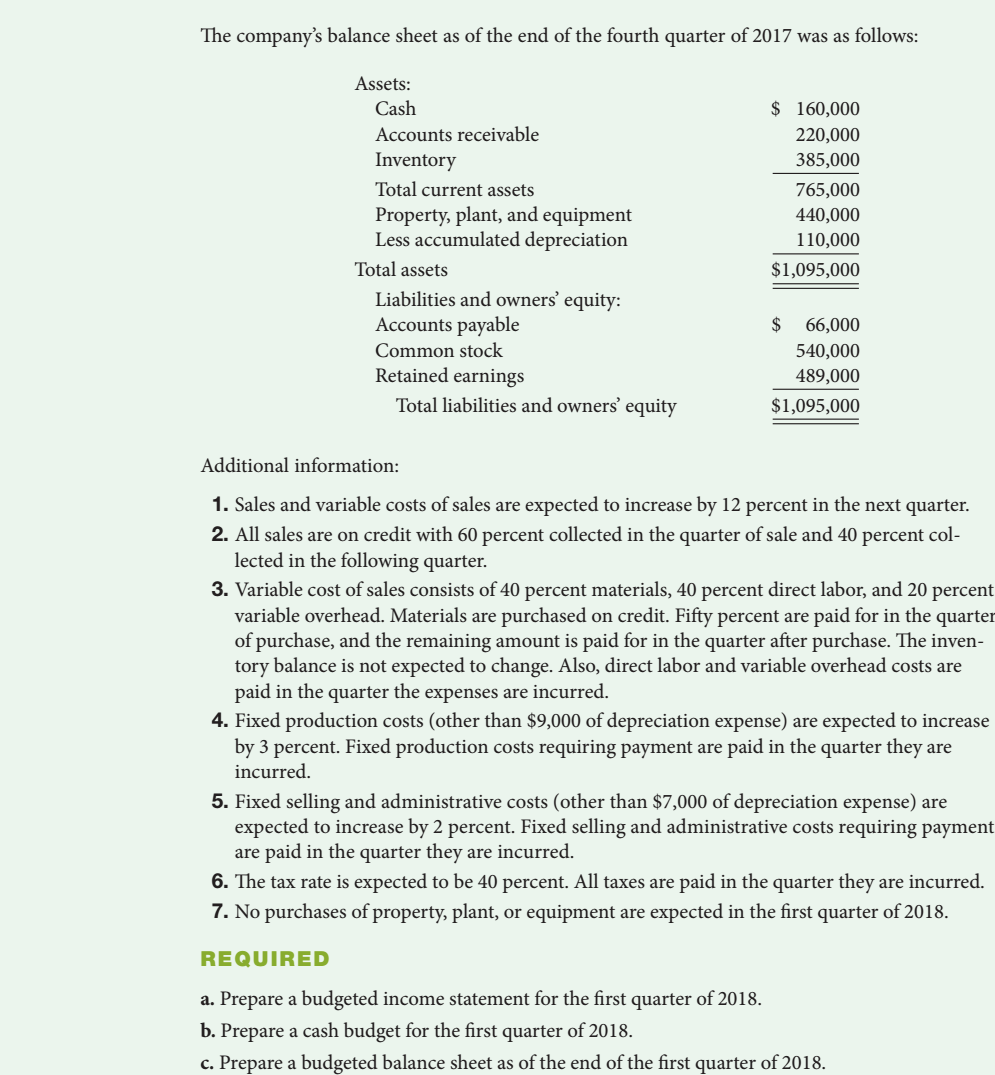

PROBLEM 10-1. Master Budget [LO 2] (Note: This problem is similar to Review Problem 2, only the numbers have been changed. Students who get stuck should consult the solution to Review Problem 2.) The results of operations for the Preston Manufacturing Company for the fourth quarter of 2017 were as follows: Note: Preston Manufacturing uses the variable costing method. Thus, only variable production costs are included in inventory and cost of goods sold. Fixed production costs are charged to expense in the period incurred. The company's balance sheet as of the end of the fourth quarter of 2017 was as follows: Additional information: 1. Sales and variable costs of sales are expected to increase by 12 percent in the next quarter. 2. All sales are on credit with 60 percent collected in the quarter of sale and 40 percent collected in the following quarter. 3. Variable cost of sales consists of 40 percent materials, 40 percent direct labor, and 20 percent variable overhead. Materials are purchased on credit. Fifty percent are paid for in the quarter of purchase, and the remaining amount is paid for in the quarter after purchase. The inventory balance is not expected to change. Also, direct labor and variable overhead costs are paid in the quarter the expenses are incurred. 4. Fixed production costs (other than $9,000 of depreciation expense) are expected to increase by 3 percent. Fixed production costs requiring payment are paid in the quarter they are incurred. 5. Fixed selling and administrative costs (other than $7,000 of depreciation expense) are expected to increase by 2 percent. Fixed selling and administrative costs requiring payment are paid in the quarter they are incurred. 6. The tax rate is expected to be 40 percent. All taxes are paid in the quarter they are incurred. 7. No purchases of property, plant, or equipment are expected in the first quarter of 2018. REQUIRED a. Prepare a budgeted income statement for the first quarter of 2018. b. Prepare a cash budget for the first quarter of 2018 . c. Prepare a budgeted balance sheet as of the end of the first quarter of 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts