Question: Problem 10-10 Capital Budgeting Methods Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for

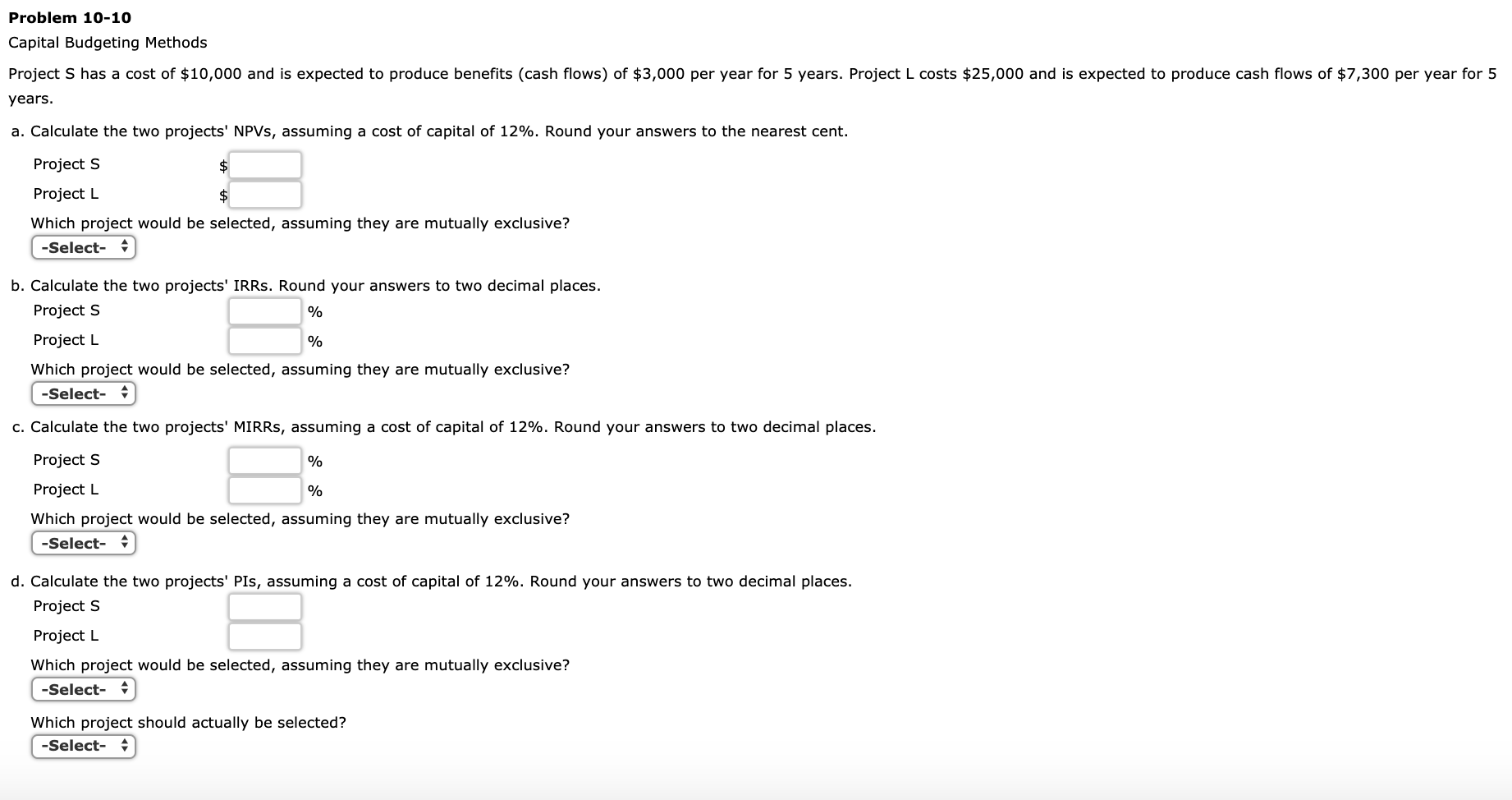

Problem 10-10 Capital Budgeting Methods Project S has a cost of $10,000 and is expected to produce benefits (cash flows) of $3,000 per year for 5 years. Project L costs $25,000 and is expected to produce cash flows of $7,300 per year for 5 years. a. Calculate the two projects' NPVs, assuming a cost of capital of 12%. Round your answers to the nearest cent. A Projects Project L A Which project would be selected, assuming they are mutually exclusive? -Select- b. Calculate the two projects' IRRs. Round your answers to two decimal places. Project S Project L Which project would be selected, assuming they are mutually exclusive? -Select- - c. Calculate the two projects' MIRRs, assuming a cost of capital of 12%. Round your answers to two decimal places. Projects Project L Which project would be selected, assuming they are mutually exclusive? ( -Select- d. Calculate the two projects' PIs, assuming a cost of capital of 12%. Round your answers to two decimal places. Project S Project L Which project would be selected, assuming they are mutually exclusive? -Select- - Which project should actually be selected? -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts