Question: Problem 10-10 (Part Level Submission) During the current year, Teal Construction trades an old crane that has a book value of $113,400 (original cost $176,400

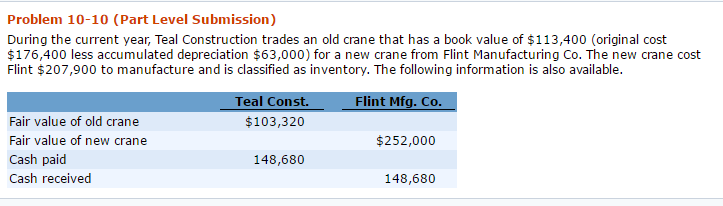

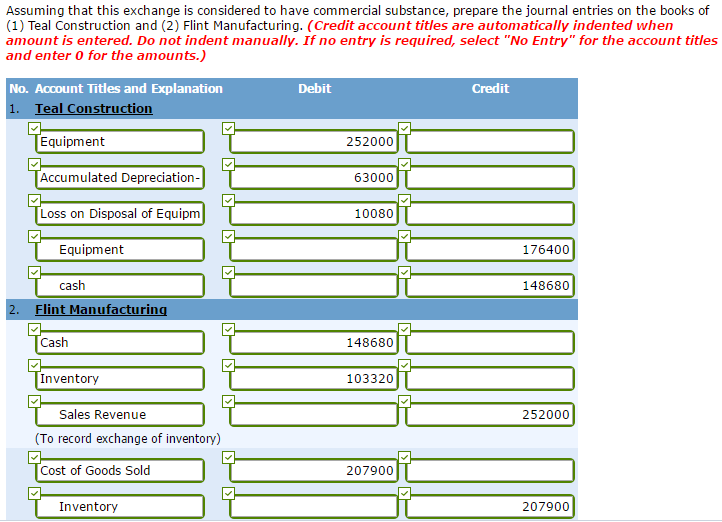

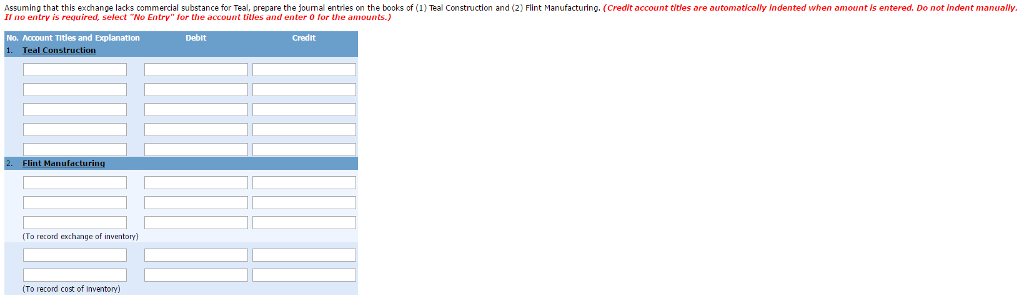

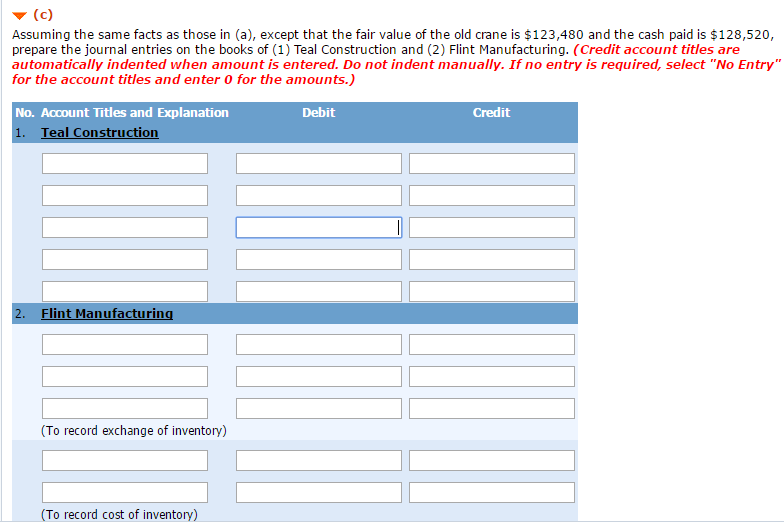

Problem 10-10 (Part Level Submission) During the current year, Teal Construction trades an old crane that has a book value of $113,400 (original cost $176,400 less accumulated depreciation $63,000) for a new crane from Flint Manufacturing Co. The new crane cost Flint $207,900 to manufacture and is classified as inventory. The following information is also available. Teal Const. Flint Mfg. Co. Fair value of old crane $103,320 Fair value of new crane $252,000 Cash paid 148,680 cash received 148,680

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts