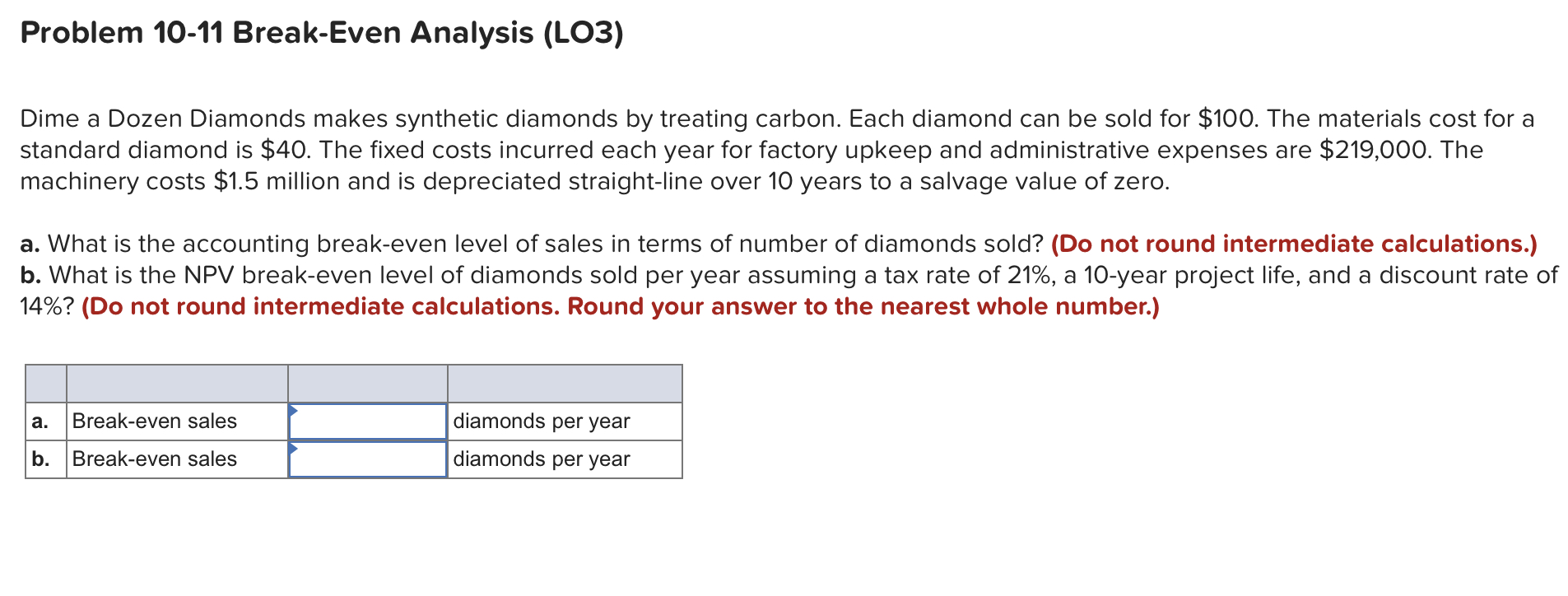

Question: Problem 10-11 Break-Even Analysis (L03) Dime a Dozen Diamonds makes synthetic diamonds by treating carbon. Each diamond can be sold for $100. The materials cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts