Question: Problem 10-13 The Sampson Company is considering a project that requires an initial outlay of $75,000 and produces cash inflows of $20,806 each year for

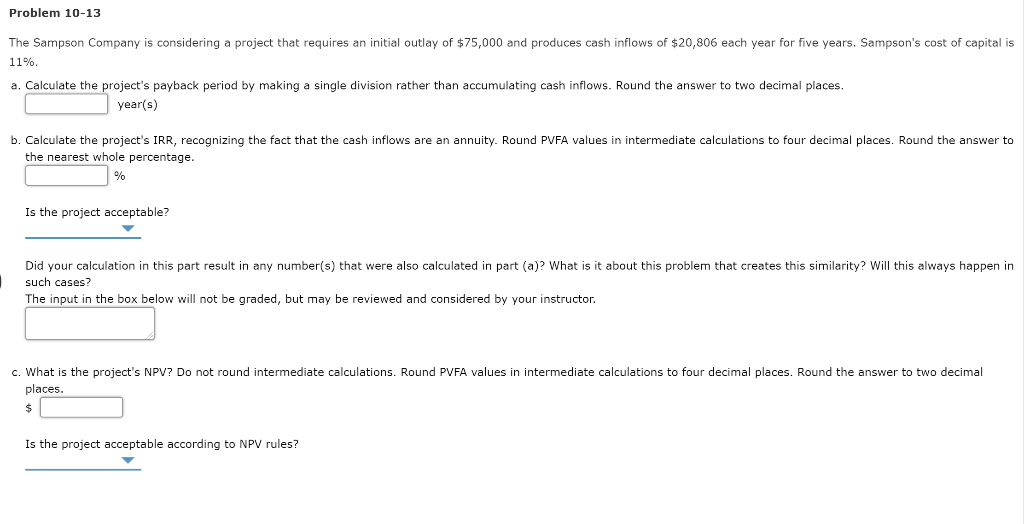

Problem 10-13 The Sampson Company is considering a project that requires an initial outlay of $75,000 and produces cash inflows of $20,806 each year for five years. Sampson's cost of capital is 11%. a. Calculate the project's payback period by making a single division rather than accumulating cash inflows. Round the answer to two decimal places. year(s) b. Calculate the project's IRR, recognizing the fact that the cash inflows are an annuity. Round PVFA values in intermediate calculations to four decimal places. Round the answer to the nearest whole percentage. Is the project acceptable? Did your calculation in this part result in any number(s) that were also calculated in part (a)? What is it about this problem that creates this similarity? Will this always happen in such cases? The input in the box below will not be graded, but may be reviewed and considered by your instructor. c. What is the project's NPV? Do not round intermediate calculations. Round PVFA values in intermediate calculations to four decimal places. Round the answer to two decimal places. Is the project acceptable according to NPV rules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts