Question: Problem 10-15 Island Airlines Inc. needs to replace a short-haul commuter plane on one of its busier routes. Two aircraft are on the market that

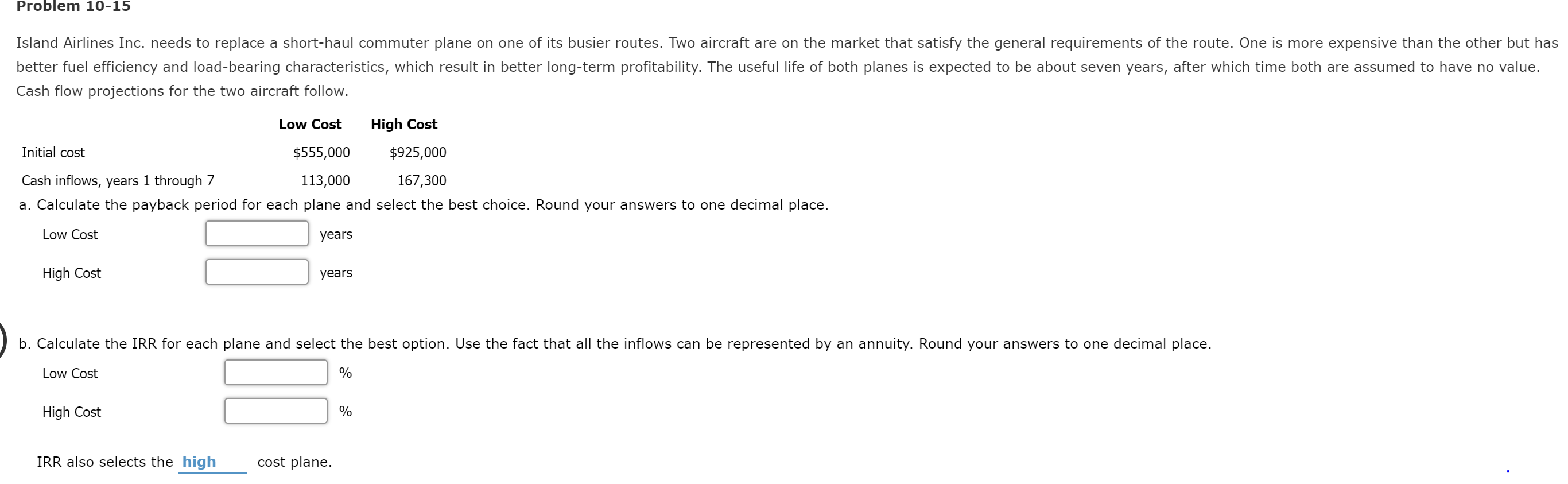

Problem 10-15 Island Airlines Inc. needs to replace a short-haul commuter plane on one of its busier routes. Two aircraft are on the market that satisfy the general requirements of the route. One is more expensive than the other but has better fuel efficiency and load-bearing characteristics, which result in better long-term profitability. The useful life of both planes is expected to be about seven years, after which time both are assumed to have no value. Cash flow projections for the two aircraft follow. Low Cost High Cost Initial cost $555,000 $925,000 Cash inflows, years 1 through 7 113,000 167,300 a. Calculate the payback period for each plane and select the best choice. Round your answers to one decimal place. Low Cost years High Cost years ) b. Calculate the IRR for each plane and select the best option. Use the fact that all the inflows can be represented by an annuity. Round your answers to one decimal place. Low Cost High Cost IRR also selects the high cost plane

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts