Question: Problem 10.18 Timeline Manufacturing Co. is evaluating two projects. The company uses payback criteria of three years or less. Project A has a cost of

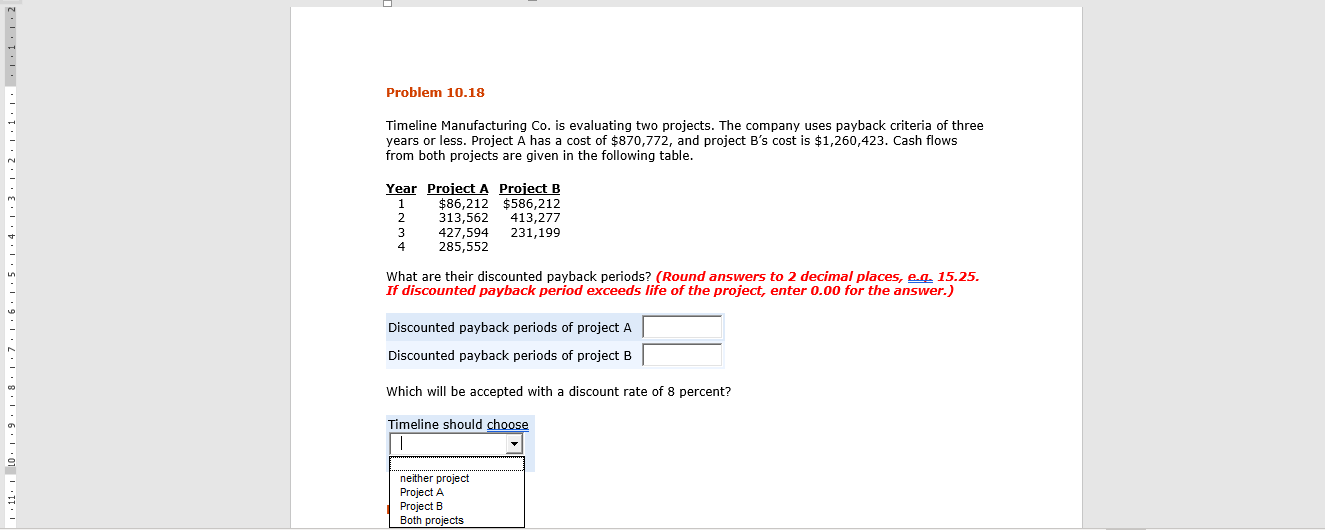

Problem 10.18 Timeline Manufacturing Co. is evaluating two projects. The company uses payback criteria of three years or less. Project A has a cost of $870,772, and project B's cost is $1,260,423. Cash flows from both projects are given in the following table. Year Project A Project B 1 $86,212 $586,212 2. 313,562 413,277 3 427,594 231,199 4 285,552 1:11:10:119:118:1.7.1.6.1.5.1.4:1131112111111111112 What are their discounted payback periods? (Round answers to 2 decimal places, e.q. 15.25. If discounted payback period exceeds life of the project, enter 0.00 for the answer.) Discounted payback periods of project A Discounted payback periods of project B Which will be accepted with a discount rate of 8 percent? Timeline should choose | neither project Project A Project B Both projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts