Question: Problem 10-18A (Algo) Postaudit evaluation LO 10-2 Brett Collins is reviewing his company's investment in a cement plant. The company paid $14,100,000 five years ago

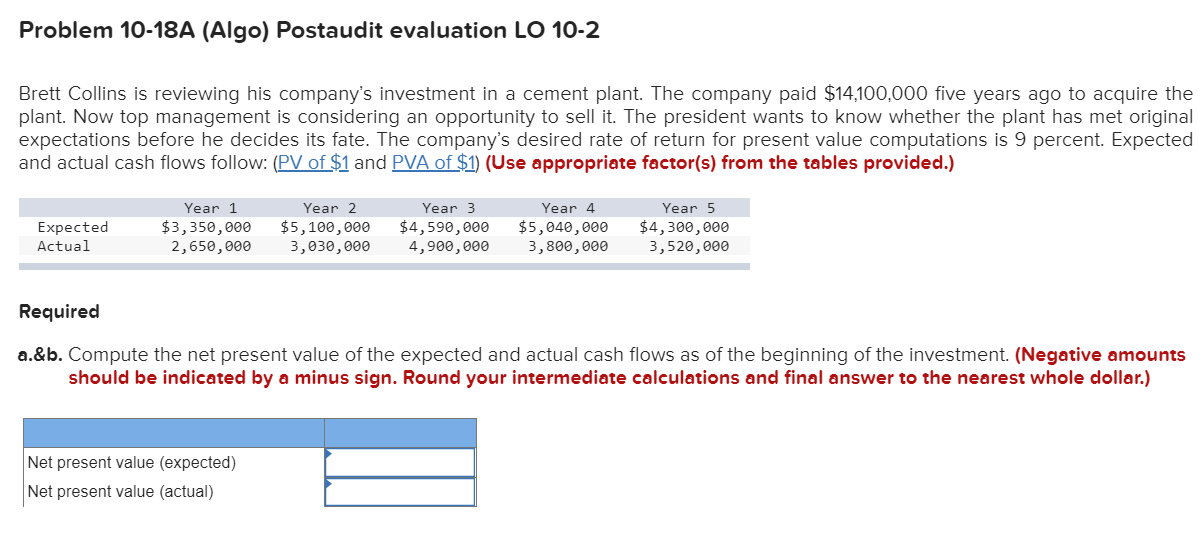

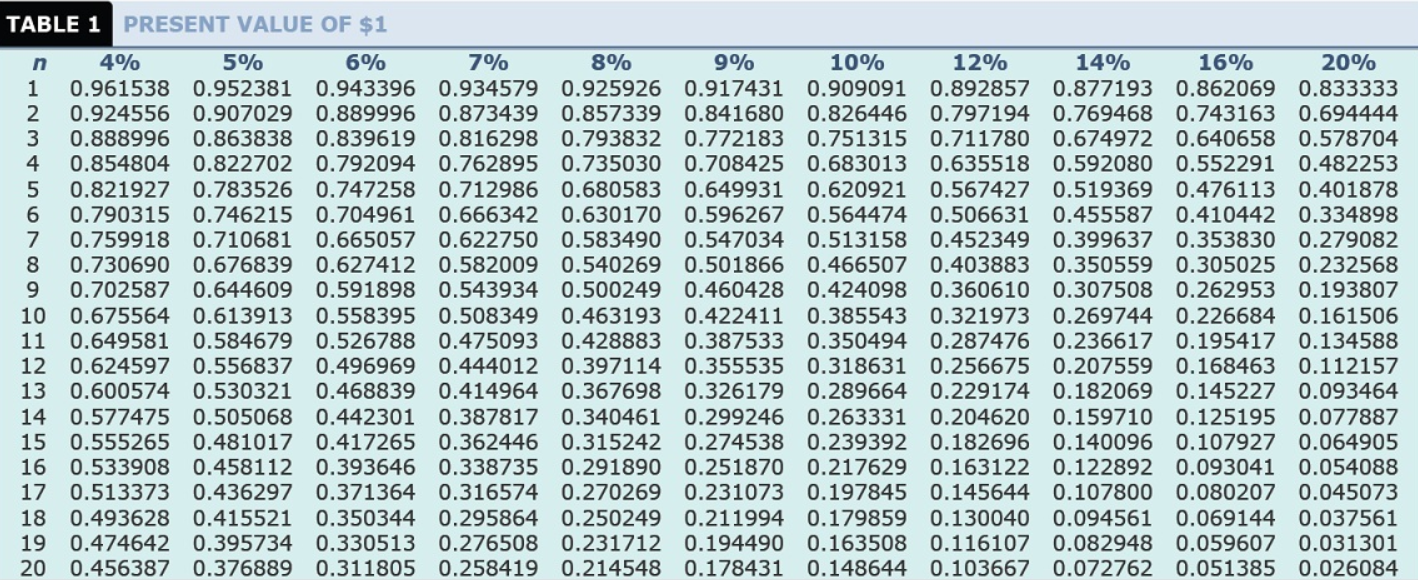

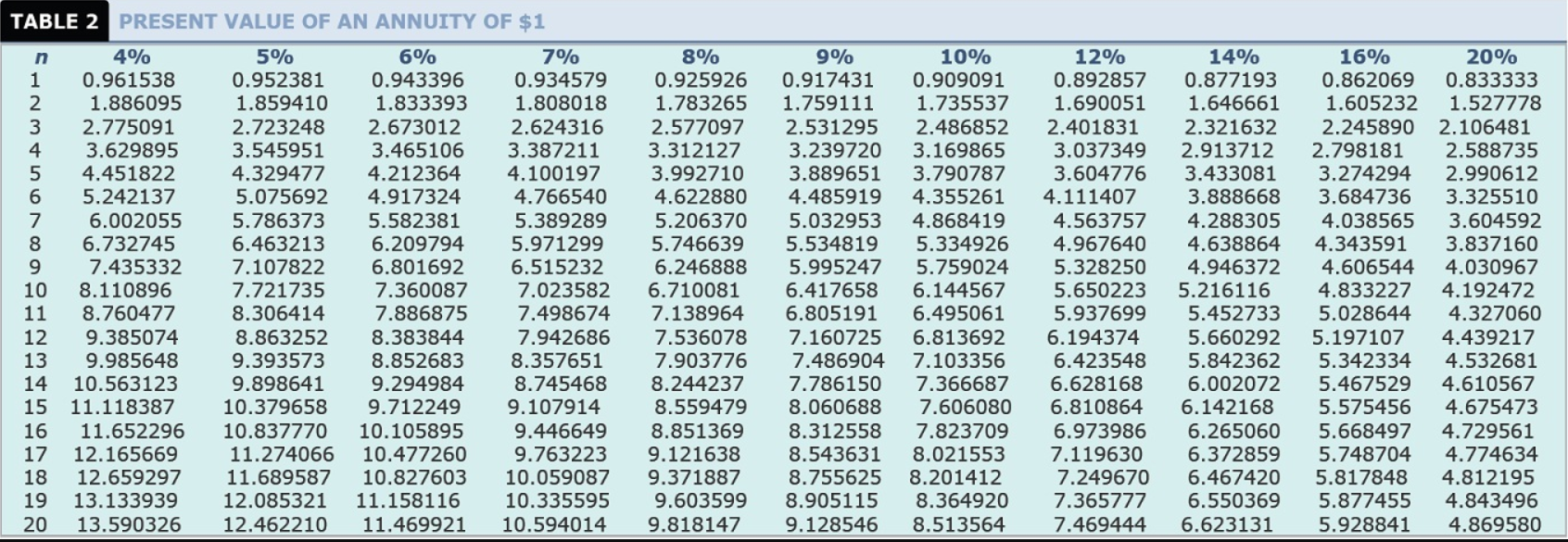

Problem 10-18A (Algo) Postaudit evaluation LO 10-2 Brett Collins is reviewing his company's investment in a cement plant. The company paid $14,100,000 five years ago to acquire the plant. Now top management is considering an opportunity to sell it. The president wants to know whether the plant has met original expectations before he decides its fate. The company's desired rate of return for present value computations is 9 percent. Expected and actual cash flows follow: (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Expected Actual Year 1 $3,350,000 2,650,000 Year 2 $5,100,000 3,030,000 Year 3 $4,590,000 4,900,000 Year 4 $5,040,000 3,800,000 Year 5 $4,300,000 3,520,000 Required a.&b. Compute the net present value of the expected and actual cash flows as of the beginning of the investment. (Negative amounts should be indicated by a minus sign. Round your intermediate calculations and final answer to the nearest whole dollar.) Net present value (expected) Net present value (actual) 999 TABLE 1 PRESENT VALUE OF $1 n 4% 5% 6% 7% 8% 9% 10% 12% 14% 16% 20% 1 0.961538 0.952381 0.943396 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 0.862069 0.833333 2 0.924556 0.907029 0.889996 0.873439 0.857339 0.841680 0.826446 0.797194 0.769468 0.743163 0.694444 3 0.888996 0.863838 0.839619 0.816298 0.793832 0.772183 0.751315 0.711780 0.674972 0.640658 0.578704 4 0.854804 0.822702 0.792094 0.762895 0.735030 0.708425 0.683013 0.635518 0.592080 0.552291 0.482253 5 0.821927 0.783526 0.747258 0.712986 0.680583 0.649931 0.620921 0.567427 0.519369 0.476113 0.401878 6 0.790315 0.746215 0.704961 0.666342 0.630170 0.596267 0.564474 0.506631 0.455587 0.410442 0.334898 7 0.759918 0.710681 0.665057 0.622750 0.583490 0.547034 0.513158 0.452349 0.399637 0.353830 0.279082 0.730690 0.676839 0.627412 0.582009 0.540269 0.501866 0.466507 0.403883 0.350559 0.305025 0.232568 9 0.702587 0.644609 0.591898 0.543934 0.500249 0.460428 0.424098 0.360610 0.307508 0.262953 0.193807 10 0.675564 0.613913 0.558395 0.508349 0.463193 0.422411 0.385543 0.321973 0.269744 0.226684 0.161506 11 0.649581 0.584679 0.526788 0.475093 0.428883 0.387533 0.350494 0.287476 0.236617 0.195417 0.134588 12 0.624597 0.556837 0.496969 0.444012 0.397114 0.355535 0.318631 0.256675 0.207559 0.168463 0.112157 13 0.600574 0.530321 0.468839 0.414964 0.367698 0.326179 0.289664 0.229174 0.182069 0.145227 0.093464 14 0.577475 0.505068 0.442301 0.387817 0.340461 0.299246 0.263331 0.204620 0.159710 0.125195 0.077887 15 0.555265 0.481017 0.417265 0.362446 0.315242 0.274538 0.239392 0.182696 0.140096 0.107927 0.064905 16 0.533908 0.458112 0.393646 0.338735 0.291890 0.251870 0.217629 0.163122 0.122892 0.093041 0.054088 17 0.513373 0.436297 0.371364 0.316574 0.270269 0.231073 0.197845 0.145644 0.107800 0.080207 0.045073 18 0.493628 0.415521 0.350344 0.295864 0.250249 0.211994 0.179859 0.130040 0.094561 0.069144 0.037561 19 0.474642 0.395734 0.330513 0.276508 0.231712 0.194490 0.163508 0.116107 0.082948 0.059607 0.031301 20 0.456387 0.376889 0.311805 0.258419 0.214548 0.178431 0.148644 0.103667 0.072762 0.051385 0.026084 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 4% 5% 6% 7% 8% 0.961538 0.952381 0.943396 0.934579 0.925926 1.886095 1.859410 1.833393 1.808018 1.783265 2.775091 2.723248 2.673012 2.624316 2.577097 3.629895 3.545951 3.465106 3.387211 3.312127 4.451822 4.329477 4.212364 4.100197 3.992710 5.242137 5.075692 4.917324 4.766540 4.622880 6.002055 5.786373 5.582381 5.389289 5.206370 6.732745 6.463213 6.209794 5.971299 5.746639 7.435332 7.107822 6.801692 6.515232 6.246888 8.110896 7.721735 7.360087 7.023582 6.710081 8.760477 8.306414 7.886875 7.498674 7.138964 9.385074 8.863252 8.383844 7.942686 7.536078 9.985648 9.393573 8.852683 8.357651 7.903776 14 10.563123 9.898641 9.294984 8.745468 8.244237 15 11.118387 10.379658 9.712249 9.107914 8.559479 16 11.652296 10.837770 10.105895 9.4466498.851369 17 12.165669 11.274066 10.477260 9.763223 9.121638 18 12.659297 11.689587 10.827603 10.0590879.371887 19 13.133939 12.085321 11.158116 10.335595 9.603599 20 13.590326 12.462210 11.469921 10.594014 9.818147 INMtos 9% 10% 0.917431 0.909091 1.759111 1.735537 2.531295 2.486852 3.239720 3.169865 3.889651 3.790787 4.485919 4.355261 5.032953 4.868419 5.534819 5.334926 5.995247 5.759024 6.417658 6.144567 6.8051916.495061 7.160725 6.813692 7.486904 7.103356 7.786150 7.366687 8.060688 7.606080 8.312558 7.823709 8.543631 8.021553 8.755625 8.201412 8.905115 8.364920 9.128546 8.513564 12% 14% 16% 20% 0.8928570.877193 0.862069 0.833333 1.690051 1.646661 1.605232 1.527778 2.401831 2.321632 2.245890 2.106481 3.037349 2.798181 2.588735 3.604776 3.433081 3.274294 2.990612 4.111407 3.888668 3.684736 3.325510 4.563757 4.288305 4.038565 3.604592 4.967640 4.343591 3.837160 5.328250 4.946372 4.606544 4.030967 5.650223 5.216116 4.833227 4.192472 5.937699 5.452733 5.0286444.327060 6.194374 5.660292 5.1971074.439217 6.423548 5.842362 5.342334 4.532681 6.628168 6.002072 5.467529 4.610567 6.810864 6.142168 5.575456 4.675473 6.973986 6.265060 5.668497 4.729561 7.119630 6.372859 5.748704 4.774634 7.249670 6.4674205.817848 4.812195 7.365777 6.550369 5.877455 4.843496 7.469444 6.623131 5.928841 4.869580 12 13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts