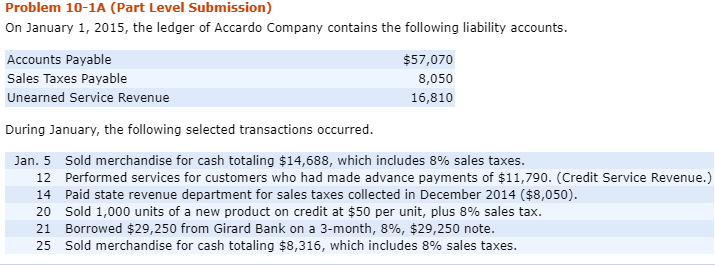

Question: Problem 10-1A (Part Level Submission) On January 1, 2015, the ledgeer of Accardo Company contains the following liability accounts. Accounts Payable $57,070 Sales Taxes Payable

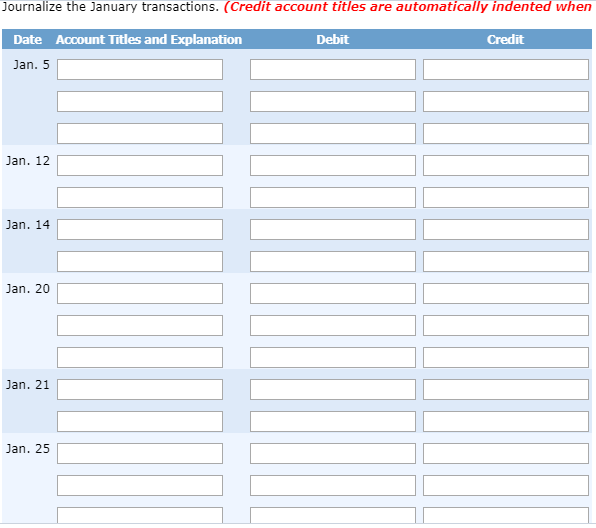

Problem 10-1A (Part Level Submission) On January 1, 2015, the ledgeer of Accardo Company contains the following liability accounts. Accounts Payable $57,070 Sales Taxes Payable 8,050 Unearned Service Revenue 16,810 During January, the following selected transactions occurred. Jan. 5 Sold merchandise for cash totaling $14,688, which includes 8% sales taxes. 12 Performed services for customers who had made advance payments of $11,790. (Credit Service Revenue.) 14 Paid state revenue department for sales taxes collected in December 2014 ($8,050) 20 Sold 1,000 units of a new product on credit at $50 per unit, plus 8% sales tax. Borrowed $29,250 from Girard Bank on a 3-month, 8%, $29,250 note 25 Sold merchandise for cash totaling $8,316, which includes 8% sales taxes. 21 Journalize the January transactions. (Credit account titles are automatically indented when Account Titles and Explanation Debit Credit Date Jan. 5 Jan. 12 Jan. 14 Jan. 20 Jan. 21 Jan. 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts