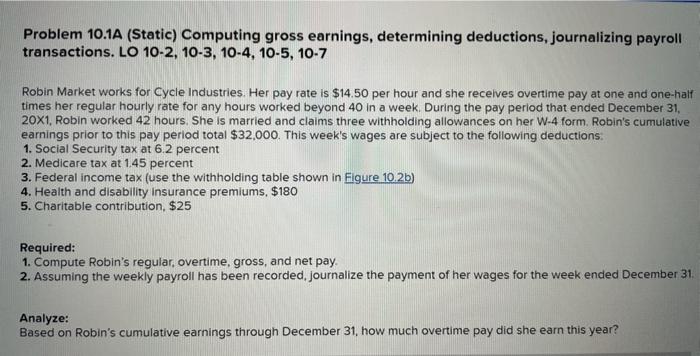

Question: Problem 10.1A (Static) Computing gross earnings, determining deductions, journalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5, 10-7 Robin Market works for Cycle Industries. Her pay

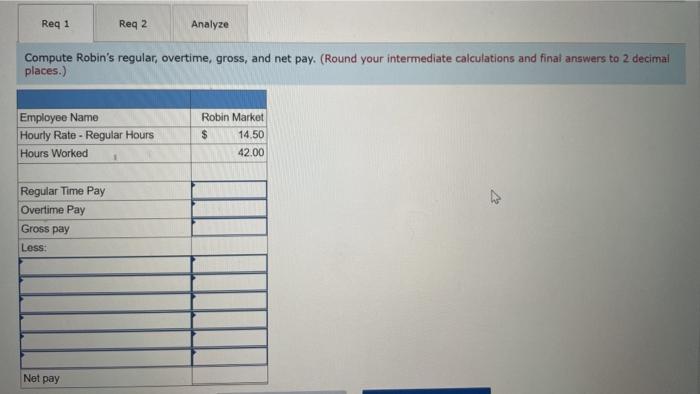

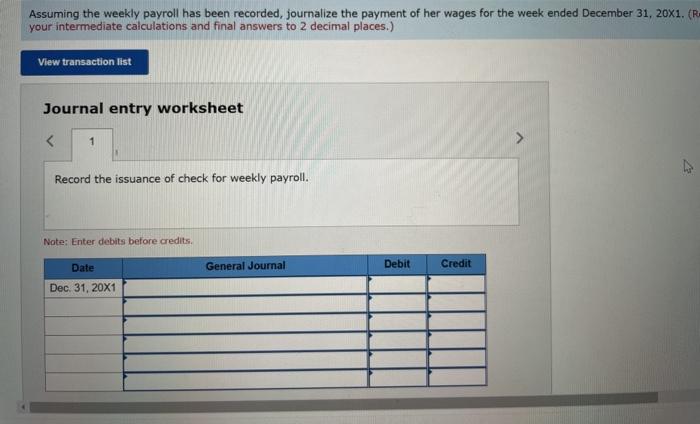

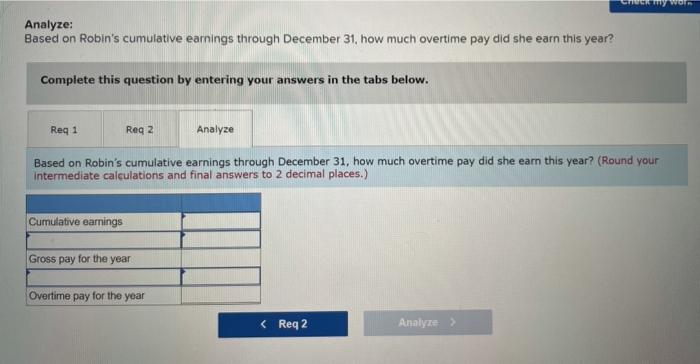

Problem 10.1A (Static) Computing gross earnings, determining deductions, journalizing payroll transactions. LO 10-2, 10-3, 10-4, 10-5, 10-7 Robin Market works for Cycle Industries. Her pay rate is $14.50 per hour and she receives overtime pay at one and one-half times her regular hourly rate for any hours worked beyond 40 in a week. During the pay period that ended December 31, 20x1, Robin worked 42 hours. She is married and claims three withholding allowances on her W-4 form. Robin's cumulative earnings prior to this pay period total $32,000. This week's wages are subject to the following deductions: 1. Social Security tax at 6.2 percent 2. Medicare tax at 1.45 percent 3. Federal income tax (use the withholding table shown in Figure 10.2b) 4. Health and disability Insurance premiums, $180 5. Charitable contribution, $25 Required: 1. Compute Robin's regular, overtime, gross, and net pay 2. Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31 Analyze: Based on Robin's cumulative earnings through December 31, how much overtime pay did she earn this year? Req 1 Reg 2 Analyze Compute Robin's regular, overtime, gross, and net pay. (Round your intermediate calculations and final answers to 2 decimal places.) Employee Name Hourly Rate - Regular Hours Hours Worked Robin Market $ 14.50 42.00 Regular Time Pay Overtime Pay Gross pay LOSS: Net pay Assuming the weekly payroll has been recorded, journalize the payment of her wages for the week ended December 31, 20X1. (R your intermediate calculations and final answers to 2 decimal places.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts