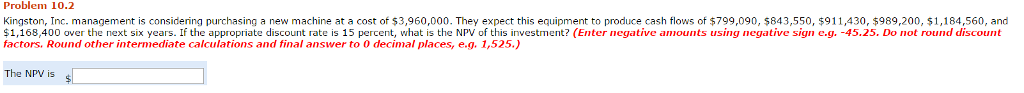

Question: Problem 10.2 Kingston, Inc. management is considering purchasing a new machine at a cost of $3,960,000. They expect this equipment to produce cash flows of

Problem 10.2 Kingston, Inc. management is considering purchasing a new machine at a cost of $3,960,000. They expect this equipment to produce cash flows of $799,090, $843,550, $911,430, $989,200, $1,184,560, and $1,168,400 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and finalanswer to 0 decinal places, e.g. 1,525.) The NPN is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts