Question: Problem 10-2 Your answer is partially correct. Try again. Selected accounts included in the property, plant, and equipment section of Coronado Corporation's balance sheet at

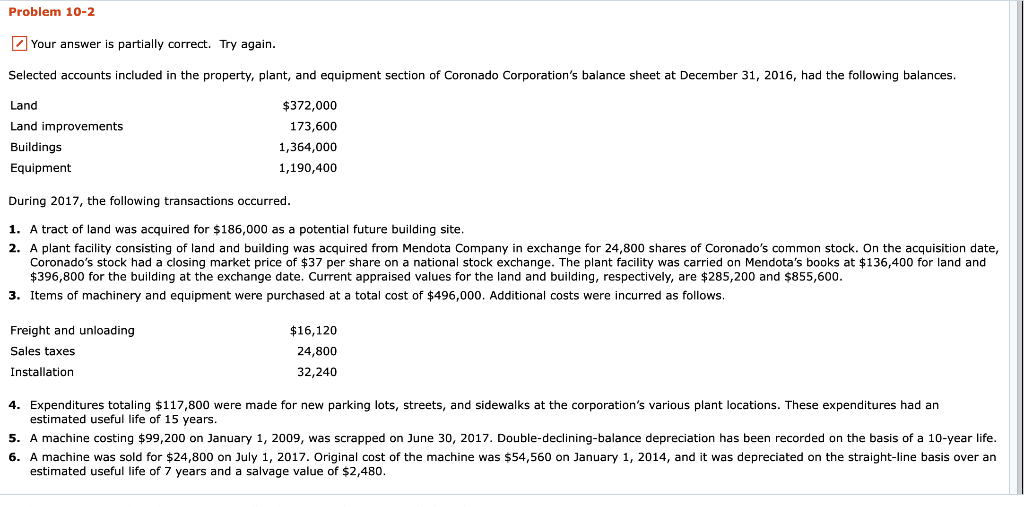

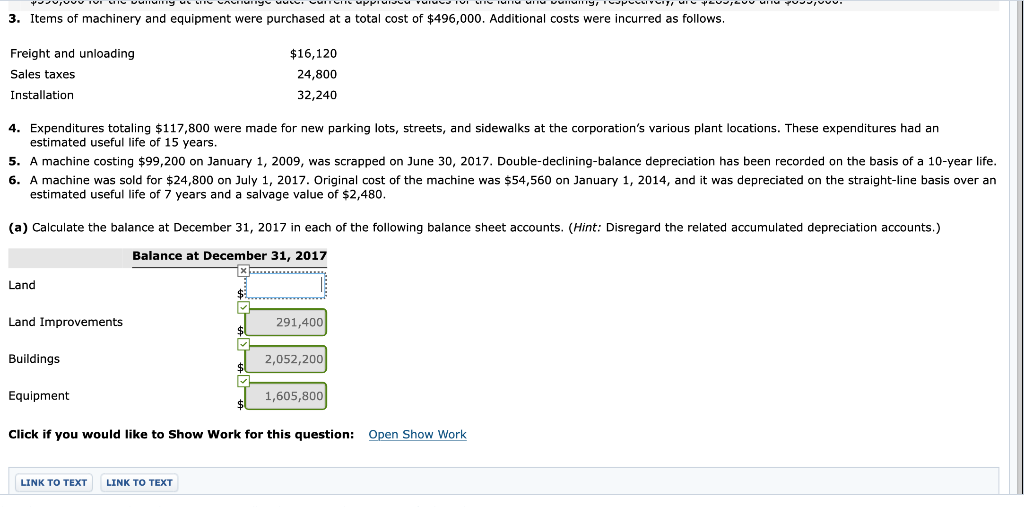

Problem 10-2 Your answer is partially correct. Try again. Selected accounts included in the property, plant, and equipment section of Coronado Corporation's balance sheet at December 31, 2016, had the following balances Land Land improvements Buildings Equipment $372,000 173,600 1,364,000 1,190,400 During 2017, the following transactions occurred 1. A tract of land was acquired for $186,000 as a potential future building site 2. A plant facility consisting of land and building was acquired from Mendota Company in exchange for 24,800 shares of Coronado's common stock. On the acquisition date, Coronado's stock had a closing market price of $37 per share on a national stock exchange. The plant facility was carried on Mendota's books at $136,400 for land and $396,800 for the building at the exchange date. Current appraised values for the land and building, respectively, are $285,200 and $855,600 3. Items of machinery and equipment were purchased at a total cost of $496,000. Additional costs were incurred as follows. Freight and unloading Sales taxes Installation $16,120 24,800 32,240 4. Expenditures totaling $117,800 were made for new parking lots, streets, and sidewalks at the corporation's various plant locations. These expenditures had an estimated useful life of 15 years 5. A machine costing $99,200 on January 1, 2009, was scrapped on June 30, 2017. Double-declining-balance depreciation has been recorded on the basis of a 10-year life 6. A machine was sold for $24,800 on July 1, 2017. Original cost of the machine was $54,560 on January 1, 2014, and it was depreciated on the straight-line basis over an estimated useful life of 7 years and a salvage value of $2,480 3. Items of machinery and equipment were purchased at a total cost of $496,000. Additional costs were incurred as follows. Freight and unloading Sales taxes Installation $16,120 24,800 32,240 4. Expenditures totaling $117,800 were made for new parking lots, streets, and sidewalks at the corporation's various plant locations. These expenditures had an estimated useful life of 15 years . A machine costing $99,200 on January 1, 2009, was scrapped on June 30, 2017. Double-declining-balance depreciation has been recorded on the basis of a 10-year life. 6. A machine was sold for $24,800 on July 1, 2017. Original cost of the machine was $54,560 on January 1, 2014, and it was depreciated on the straight-line basis over an estimated useful life of 7 years and a salvage value of $2,480 (a) Calculate the balance at December 31, 2017 in each of the following balance sheet accounts. (Hint: Disregard the related accumulated depreciation accounts) Balance at December 31, 2017 Land Land Improvements 291,400 Buildings 2,052,200 Equipment 1,605,800 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts