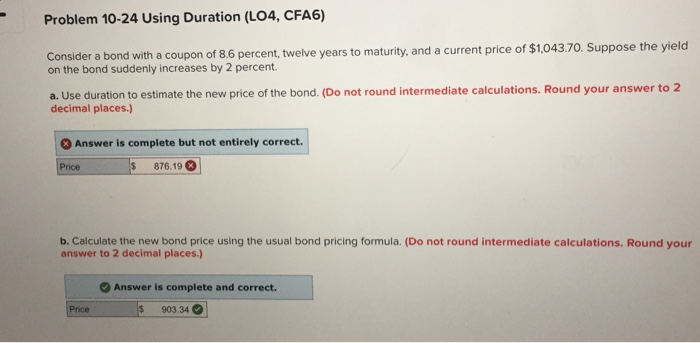

Question: Problem 10-24 Using Duration (1L04, CFA6) Consider a bond with a coupon of 8 6 percent, twelve years to maturity, and a current price of

Problem 10-24 Using Duration (1L04, CFA6) Consider a bond with a coupon of 8 6 percent, twelve years to maturity, and a current price of $1,043.70. Suppose the yield on the bond suddenly increases by 2 percent a. Use duration to estimate the new price of the bond. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Price 87619 b. Calculate the new bond price using the usual bond pricing formula. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Answer is complete and correct. 903.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts