Question: Problem 10-25 Using Return Distributions [LO 3 Assume the returns from holding small-company stocks are normally distributed. Also assume the average annual return for holding

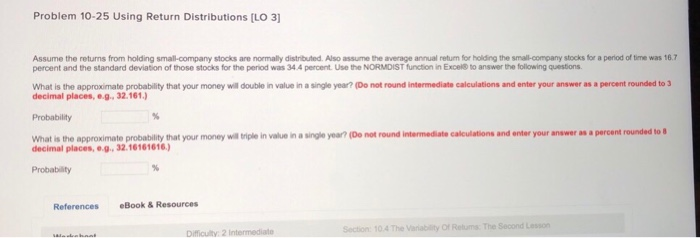

Problem 10-25 Using Return Distributions [LO 3 Assume the returns from holding small-company stocks are normally distributed. Also assume the average annual return for holding the small-company stocks for a period of time was 16.7 percent and the standard deviation of those stocks for the pend was 34 4 percent use the NORMDST fundon n Exce0 to answer the folio ing omsons. What is the approximate probability that your money will double in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 3 decimal places, e.g. 32.161 Probability What is the approximate probability that your money will tiple in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to decimal places,e.g. 32.16161616) Probability References eBook&Resources 10.4 The Variability Of Retums The Second Lesson Difficulty: 2 Intermediate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts