Question: Problem 10-27 Comparing Mutually Exclusive Projects (L04) Vandelay Industries is considering the purchase of a new machine for the production of latex. Machine A costs

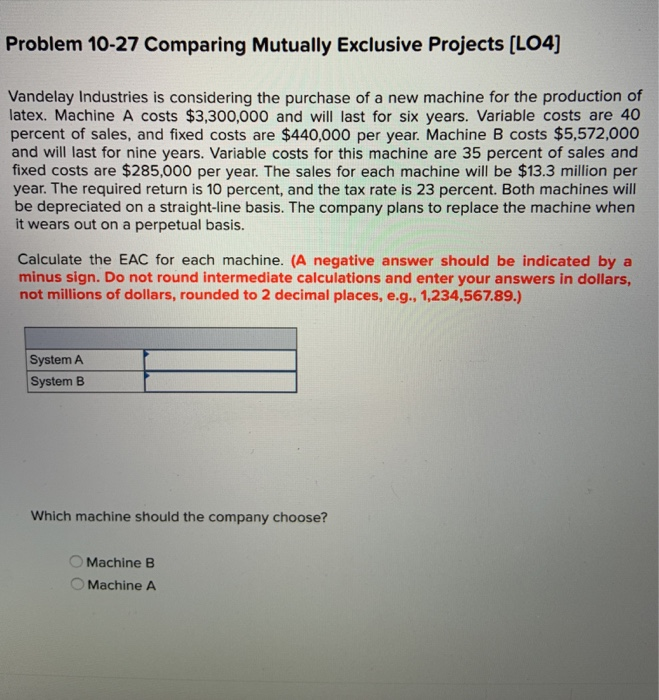

Problem 10-27 Comparing Mutually Exclusive Projects (L04) Vandelay Industries is considering the purchase of a new machine for the production of latex. Machine A costs $3,300,000 and will last for six years. Variable costs are 40 percent of sales, and fixed costs are $440,000 per year. Machine B costs $5,572,000 and will last for nine years. Variable costs for this machine are 35 percent of sales and fixed costs are $285,000 per year. The sales for each machine will be $13.3 million per year. The required return is 10 percent, and the tax rate is 23 percent. Both machines will be depreciated on a straight-line basis. The company plans to replace the machine when it wears out on a perpetual basis. Calculate the EAC for each machine. (A negative answer should be indicated by a minus sign. Do not round Intermediate calculations and enter your answers in dollars, not millions of dollars, rounded to 2 decimal places, e.g., 1,234,567.89.) System A System B Which machine should the company choose? Machine B Machine A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts