Question: Problem 10.2A (Algo) Computing gross earnings, determining deductions, preparing payroll register, Journallzing payroll transactions. LO 10-2, 10-3, 10-4, 10-5 Low Country Goods has four employees

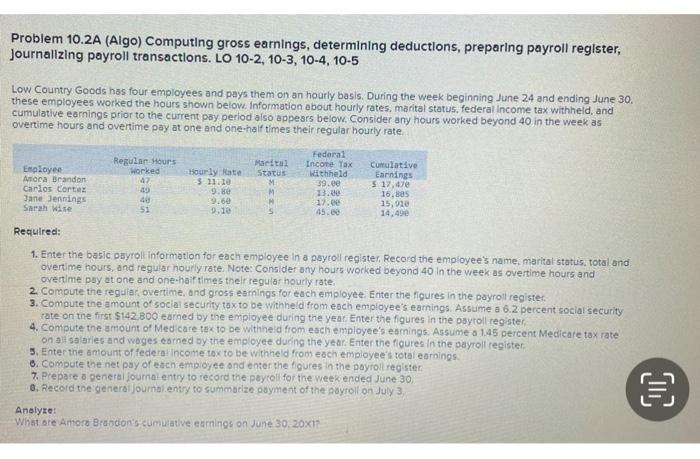

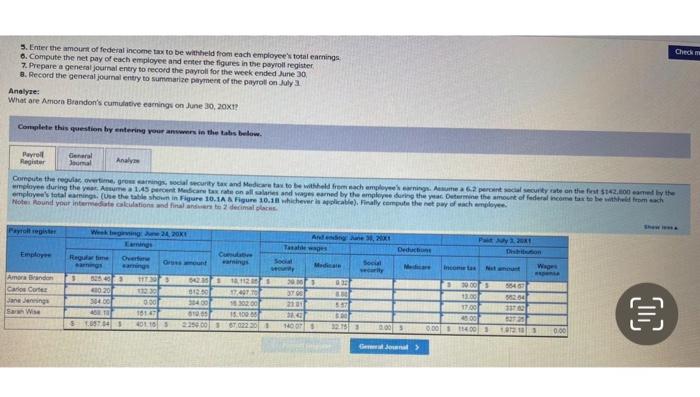

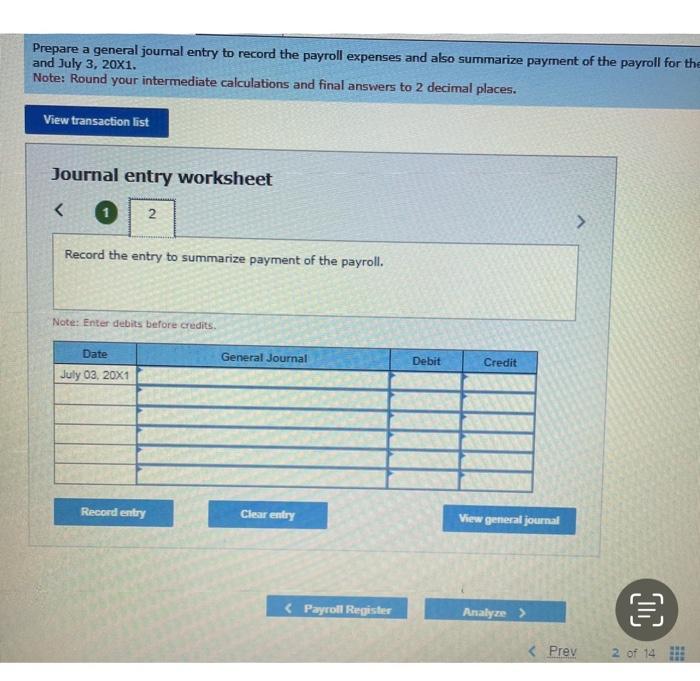

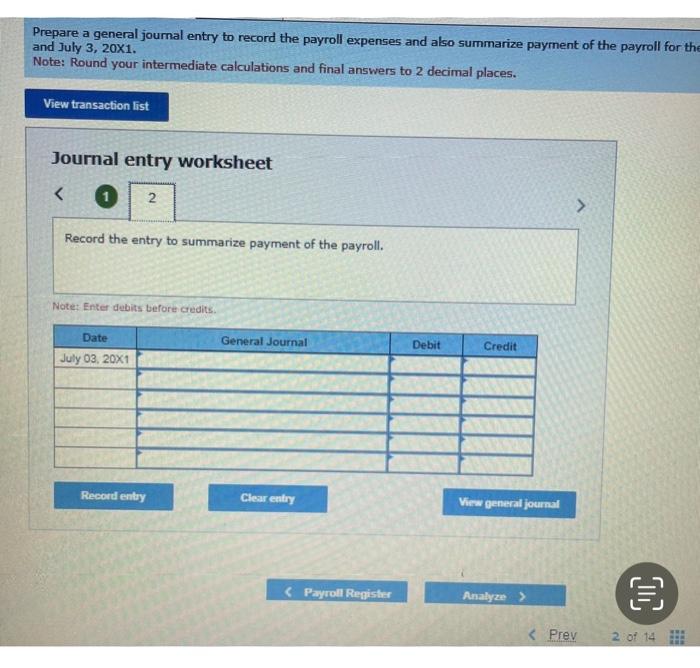

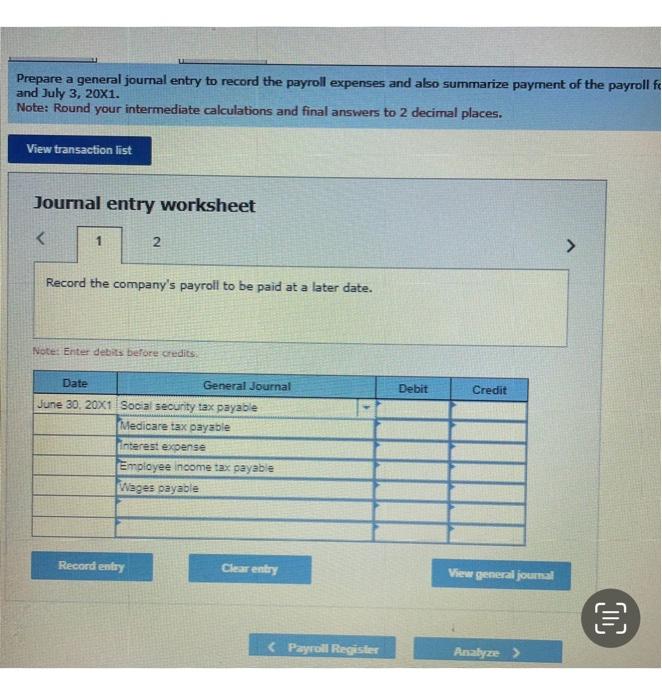

Problem 10.2A (Algo) Computing gross earnings, determining deductions, preparing payroll register, Journallzing payroll transactions. LO 10-2, 10-3, 10-4, 10-5 Low Country Goods has four employees and pays them on an hourly basis, During the week beginning June 24 and ending June 30 . these employees worked the hours shown below, Information about hourly rates, marital status, federal income tax withheld, and cumulative earnings prior to the current pay period also appears below. Consider any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-half times their regular hourly rate. Required: 1. Enter the basic payroli information for each employee in a poyroll register, Record the empioyees name, marital status, total and overtime hours, and regular hourly rate. Note: Conslder any hours worked beyond 40 in the week as overtime hours and overtime pay at one and one-haif times their regular hourly rate. 2. Compute the regular, overtime, ond gross earnings for each employee. Enter the figures in the payroil register. 3. Compute the amount of social security tax to be with heid from each employee's earnings. Assume a 6.2 percent social security rate on the first $142,800 earned by the employee during the year. Enter the figures in the psytoll regiater. 4. Compute the amount of Med care tax to be withneld from esch employee's earnings. Assume o 1.45 percent Medicare tax rate on al salaries and wages earned by the employee during the year. Enter the foures in the payroll register: 6. Compute the net pay of eacn emp oyce ond enter the figures in the poyroll register 7. Prepare o peneral journal entry to record the poyroll for the week ended June 30 . 0. Record the general joumalientry to summorize poyment of the poyroll on July 3 . Anolyze: What sere Amoro Brandon's cumuatwe eamings on June 30, 20x1? 3. Enter the amount of federal income tax to be witheld from each employee's total earnings. Q. Compute the net pay of each employee and enter the figures in the poynoll register 7. Prepare a general journal enery to record the payroll for the week endied Jurie 30 . 8. Record the general journal entry to summarize patyment of the paysol on July 3 Analyze: What are Amoen Eitandon's cumulative earnings on June 30,201 ? Consplete this question by entering vour anumers is the tabs below. Prepare a general journal entry to record the payroll expenses and also summarize payment of the payroll for th and July 3,201. Note: Round your intermediate calculations and final answers to 2 decimal places. Journal entry worksheet Record the entry to summarize payment of the payroll. Note: Enter debits before credits. Prepare a general joumal entry to record the payroll expenses and also summarize payment of the payroll for th and July 3,201. Note: Round your intermediate calculations and final answers to 2 decimal places. Journal entry worksheet Record the entry to summarize payment of the payroll. Note: Enter debits before credits. Prepare a general journal entry to record the payroll expenses and also summarize payment of the payroll and July 3, 201. Note: Round your intermediate calculations and final answers to 2 decimal places. Journal entry worksheet Record the company's payroll to be paid at a later date. Note: Enter debits before ctedits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts