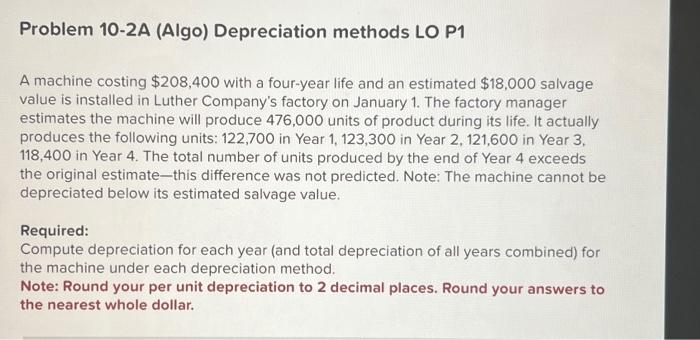

Question: Problem 10-2A (Algo) Depreciation methods LO P1 A machine costing $208,400 with a four-year life and an estimated $18,000 salvage value is installed in Luther

Problem 10-2A (Algo) Depreciation methods LO P1 A machine costing $208,400 with a four-year life and an estimated $18,000 salvage value is installed in Luther Company's factory on January 1 . The factory manager estimates the machine will produce 476,000 units of product during its life. It actually produces the following units: 122,700 in Year 1, 123,300 in Year 2,121,600 in Year 3. 118,400 in Year 4 . The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar. Problem 10-2A (Algo) Depreciation methods LO P1 A machine costing $208,400 with a four-year life and an estimated $18,000 salvage value is installed in Luther Company's factory on January 1 . The factory manager estimates the machine will produce 476,000 units of product during its life. It actually produces the following units: 122,700 in Year 1, 123,300 in Year 2,121,600 in Year 3. 118,400 in Year 4 . The total number of units produced by the end of Year 4 exceeds the original estimate-this difference was not predicted. Note: The machine cannot be depreciated below its estimated salvage value. Required: Compute depreciation for each year (and total depreciation of all years combined) for the machine under each depreciation method. Note: Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts