Question: Problem 10.35 Crane Corp. management is evaluating two mutually exclusive projects. The cost of capital is 15 percent. Costs and cash flows for each project

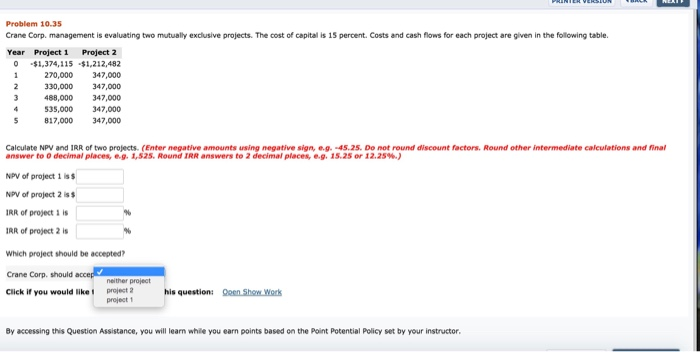

Problem 10.35 Crane Corp. management is evaluating two mutually exclusive projects. The cost of capital is 15 percent. Costs and cash flows for each project are given in the following table. Year Project 1 Project 2 0 $1,374,115 $1,212,482 1 270.000 347.000 330,000 347,000 488,000 347,000 535,000 347,000 817,000 347,000 Calculate NPV and IRR of two projects. (Enter negative amounts using negative sign, e.o. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to o decimal places, e.g. 1,525. Round IRR answers to 2 decimal places, e.o. 15.25 or 12.25.) NPV of project 1 ss NPV of project 2 is $ IRR of project is IRR of project 2 is which project should be accepted? Crane Corp, should accep Click if you would like i neither project project 2 project 1 his question: Open Show Work By accessing this Question Assistance, you will learn while you earn points based on the Point Potential Policy set by your instructor

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts