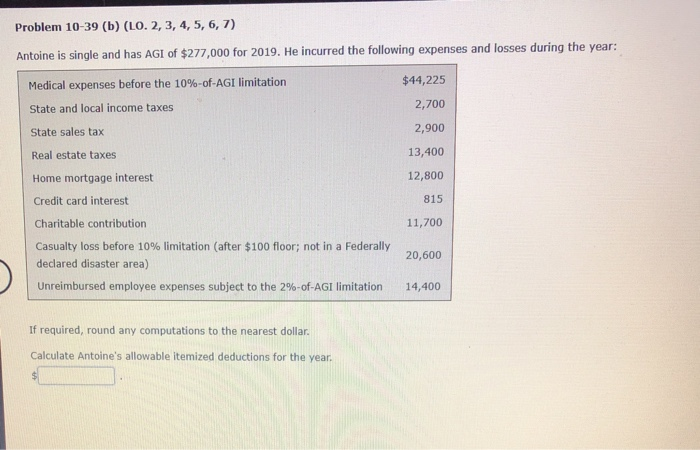

Question: Problem 10-39 (b) (LO. 2, 3, 4, 5, 6, 7) Antoine is single and has AGI of $277,000 for 2019. He incurred the following expenses

Problem 10-39 (b) (LO. 2, 3, 4, 5, 6, 7) Antoine is single and has AGI of $277,000 for 2019. He incurred the following expenses and losses during the year: $44,225 Medical expenses before the 10%-of-AGI limitation State and local income taxes 2,700 State sales tax 2,900 Real estate taxes 13,400 Home mortgage interest 12,800 Credit card interest 815 11,700 Charitable contribution Casualty loss before 10% limitation (after $100 floor; not in a Federally declared disaster area) Unreimbursed employee expenses subject to the 2%-of-AGI limitation 20,600 14,400 If required, round any computations to the nearest dollar. Calculate Antoine's allowable itemized deductions for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts