Question: Problem 10-4 Absorption Costing versus Variable Costing Lassen Corporation has determined the following selling price and manufacturing cost per unit based on normal production of

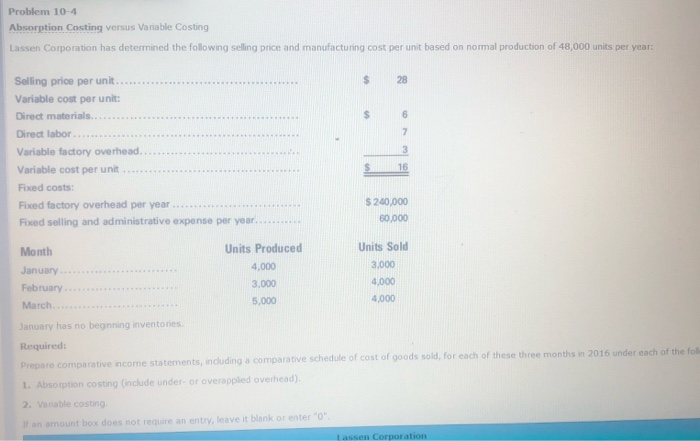

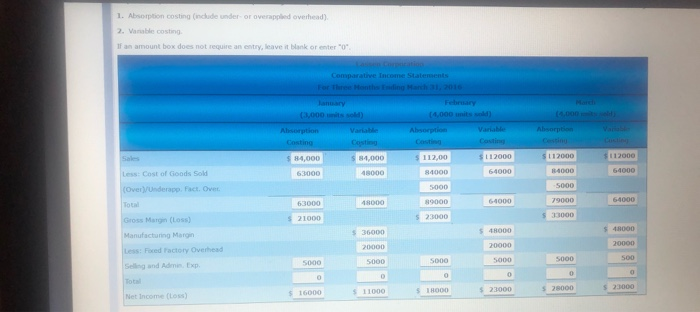

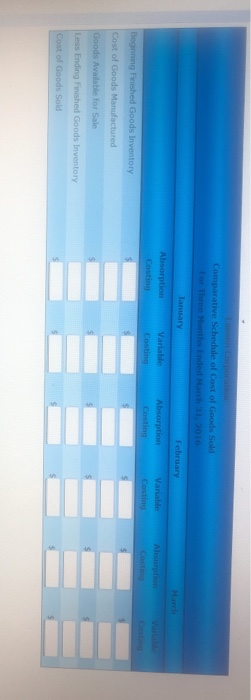

Problem 10-4 Absorption Costing versus Variable Costing Lassen Corporation has determined the following selling price and manufacturing cost per unit based on normal production of 48,000 units per year: 28 6 7 Selling price per unit. Variable cost per unit: Direct materials. Direct labor. Variable factory overhead. Variable cost per unit Fixed costs Fixed factory overhead per year... Fixed selling and administrative expense per year... 3 $ 16 $ 240,000 80,000 Month Units Produced Units Sold January 4,000 3,000 February 3.000 4,000 March 5,000 4,000 January has no beginning inventories Required: Prepare comparative income statements, including a comparative schedule of cost of goods sold, for each of these three months in 2016 under each of the fol 1. Absorption costing (include under or overappled overhead) 2. Variable costing an amount box does not require an entry, leave it blank or enter"0" Tassen Corporation 1. Absorption costing (ndade under or overapplied overhead) 2. Vanable costing If an amount box does not require an entry leave it blank or enter"0" Comparative Income Statements Absorption (3,000 units sold) Absorption Costing Costa 84,000 S 14,000 63000 48000 February (4.000 units Absorption Casti Casting $ 112,00 12000 84000 64000 Sale $112000 112000 34000 64000 Less Cost of Goods Sold (Over/Underapp. Fact Over 5000 5000 6.1000 48000 99000 64000 79000 Total 6-4000 21000 23000 2000 5 36000 $ 48000 540000 Gross Margon (Loss) Manufacturing Maran Less Fed Factory Overhead Selling and Admin Exp 20000 20000 20000 5000 5000 5000 5000 500 5000 0 0 0 11000 521000 $2.000 5TH000 520000 16000 Net Income (Loss) Comparative Schedule of Cost of Goods Sold January February March Absorption Costing Variable Vanable Absorption Costing Beginning Finished Goods Inventory Cost of Goods Manufactured Goods Available for Sale Less Ending Finished Goods Inventory Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts