Question: Problem 10-4 (Algorithmic) Partnership Formation (LO 10.2) Juanita contributes property with a fair market value of $42,000 and an adjusted basis of $12,600 to

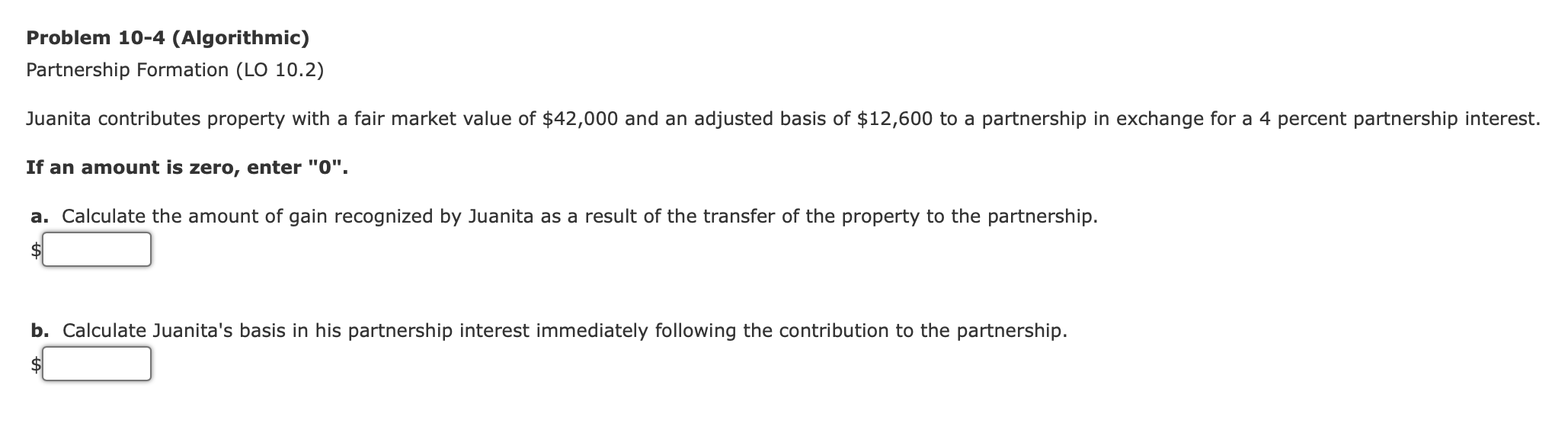

Problem 10-4 (Algorithmic) Partnership Formation (LO 10.2) Juanita contributes property with a fair market value of $42,000 and an adjusted basis of $12,600 to a partnership in exchange for a 4 percent partnership interest. If an amount is zero, enter "0". a. Calculate the amount of gain recognized by Juanita as a result of the transfer of the property to the partnership. b. Calculate Juanita's basis in his partnership interest immediately following the contribution to the partnership.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock