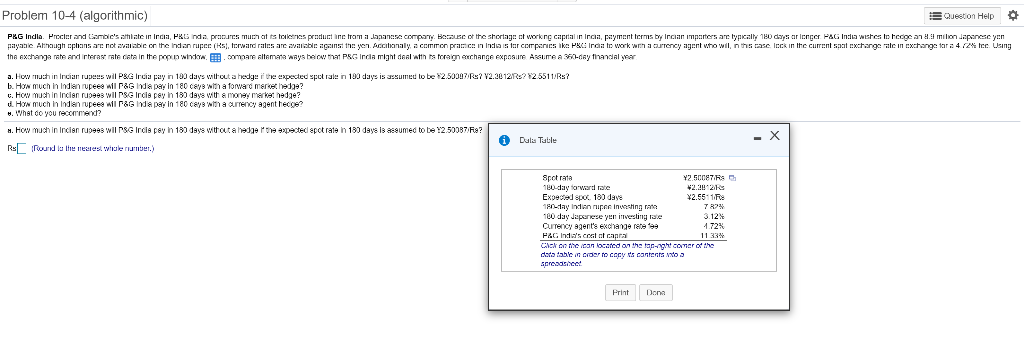

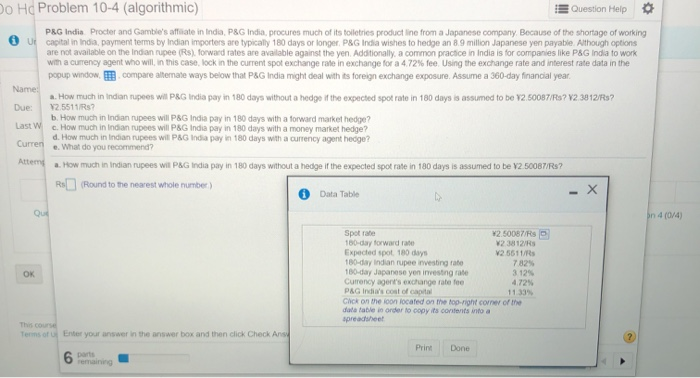

Question: Problem 10-4 (algorithmic) Question Help PKG India, Procter and Gamble's state in India, Panda pranuesmu atstones praturtiniram a anana company House of the sheriaan at

Problem 10-4 (algorithmic) Question Help PKG India, Procter and Gamble's state in India, Panda pranuesmu atstones praturtiniram a anana company House of the sheriaan at work caprinin incin, payment terms by Ircian importers are typially 180 days ar lenger P&G India wishes to hedge and milion Japanese yen payale Athough plans ar not available on the indan rupee (Rs, forward rates are available against the yer Acconaly a common panchina iar copernika P iraal work with a currency agent who wil in the raseInck in the current saat exchange rate in exchange tar 424 Ice Using the exchange rate and interest rate data in the paper windy . Mane Altemala 'ways be that PSG India might deal with its foraign exchange exposune Assume a day thancial year a. How much in Indian rugeus wil P&G Ircia pay in 100 days without a hedge the expected epcrale in 190 days is asumed to be 42.50397R? V2.2012102925511:Rs? b. HON much in Indian rupeee wil r&G Indepey in 180 cells with a forward market lege? c. How much in Indien u wil rs Ircis pay in 180 days with money market hedge? d. How much in Indian rupees wil r& d pay in 180 days with a currency agent hege? What do you remet? M. How much in Indian rupee wil rs Ircie pay in 180 days without and the expected spot rate in 180 days is 868umed to be 12.500B7F18? Dula Tatile - X RC Round late negres while mbet.) Sretrata Y2 50087s 10-day toward te Expected so. 180 days 2.99 190-tay Indian rupee investing rane 7 82% 100 day Japanese yen investing ise 3.12% Ourrency egent's exchange rate 199 P&C India's coat o canta 11 33% CINO the can located on the tac-nght corner of the datatable cro c canters to act 472% Print Dona Do Ho Problem 10-4 (algorithmic) Question Help Ut PAG India Procter and Gamble's affiliate in India, PSG India procures much of its toiletries product line from a Japanese company. Because of the shortage of working i lin india payment terms by Indian importers are typically 180 days or longer PSG India wishes to hedge an 8.9 million Japanese yen payable. Although options are not a ble on the Indian rupee Rs forward rates are a ble against the yen Additionally a common pracsce in India is for companies like PSG India to work with a currency agent who will in this case, lock in the current spot exchange rate in exchange for a 472 fee. Using the exchange rate and interest rate data in the DOUD Window compare attemate ways below that PSG India might deal with a foreign exchange exposure. Assume a 300-day financial year Name m ed to be 12 50087 ?V2 3812 RS? Due Last w How much in indian rupees P inda ay in 10 days without a hedge the expected spot rate in 180 da 12 5511 R How much in Indian rupees will PSG India pay in 180 days with a forward market hede? How much in Indian rupees will PSG India Day in 180 days with a money market hedge? d. How much in Indian Rupees wit PSG Inda pay in 180 days with a currency agent heoge? What do you recommend? Curren Anem How much in Indian rupees wil PSG India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be V2 50087/RS? RS (Round to the nearest whole number) 0 Data Table ( Spettate Y2 50087/RSS 150-day forward W2112 Expected spot 100 days 2 551 180-day Indian rupee nvestigate 7825 150-day Japanese yen nga 312 Cuency change Paino 11 Cack on the son located on the tonant corner of the spreadsheet Terms of uf Enter your answer in the answer box and then click Check Anal Print Done parts b Problem 10-4 (algorithmic) Question Help PKG India, Procter and Gamble's state in India, Panda pranuesmu atstones praturtiniram a anana company House of the sheriaan at work caprinin incin, payment terms by Ircian importers are typially 180 days ar lenger P&G India wishes to hedge and milion Japanese yen payale Athough plans ar not available on the indan rupee (Rs, forward rates are available against the yer Acconaly a common panchina iar copernika P iraal work with a currency agent who wil in the raseInck in the current saat exchange rate in exchange tar 424 Ice Using the exchange rate and interest rate data in the paper windy . Mane Altemala 'ways be that PSG India might deal with its foraign exchange exposune Assume a day thancial year a. How much in Indian rugeus wil P&G Ircia pay in 100 days without a hedge the expected epcrale in 190 days is asumed to be 42.50397R? V2.2012102925511:Rs? b. HON much in Indian rupeee wil r&G Indepey in 180 cells with a forward market lege? c. How much in Indien u wil rs Ircis pay in 180 days with money market hedge? d. How much in Indian rupees wil r& d pay in 180 days with a currency agent hege? What do you remet? M. How much in Indian rupee wil rs Ircie pay in 180 days without and the expected spot rate in 180 days is 868umed to be 12.500B7F18? Dula Tatile - X RC Round late negres while mbet.) Sretrata Y2 50087s 10-day toward te Expected so. 180 days 2.99 190-tay Indian rupee investing rane 7 82% 100 day Japanese yen investing ise 3.12% Ourrency egent's exchange rate 199 P&C India's coat o canta 11 33% CINO the can located on the tac-nght corner of the datatable cro c canters to act 472% Print Dona Do Ho Problem 10-4 (algorithmic) Question Help Ut PAG India Procter and Gamble's affiliate in India, PSG India procures much of its toiletries product line from a Japanese company. Because of the shortage of working i lin india payment terms by Indian importers are typically 180 days or longer PSG India wishes to hedge an 8.9 million Japanese yen payable. Although options are not a ble on the Indian rupee Rs forward rates are a ble against the yen Additionally a common pracsce in India is for companies like PSG India to work with a currency agent who will in this case, lock in the current spot exchange rate in exchange for a 472 fee. Using the exchange rate and interest rate data in the DOUD Window compare attemate ways below that PSG India might deal with a foreign exchange exposure. Assume a 300-day financial year Name m ed to be 12 50087 ?V2 3812 RS? Due Last w How much in indian rupees P inda ay in 10 days without a hedge the expected spot rate in 180 da 12 5511 R How much in Indian rupees will PSG India pay in 180 days with a forward market hede? How much in Indian rupees will PSG India Day in 180 days with a money market hedge? d. How much in Indian Rupees wit PSG Inda pay in 180 days with a currency agent heoge? What do you recommend? Curren Anem How much in Indian rupees wil PSG India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be V2 50087/RS? RS (Round to the nearest whole number) 0 Data Table ( Spettate Y2 50087/RSS 150-day forward W2112 Expected spot 100 days 2 551 180-day Indian rupee nvestigate 7825 150-day Japanese yen nga 312 Cuency change Paino 11 Cack on the son located on the tonant corner of the spreadsheet Terms of uf Enter your answer in the answer box and then click Check Anal Print Done parts b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts