Question: Problem 10-40 (Algorithmic) (LO. 2, 3, 4, 5, 6, 7) For calendar year 2020, Stuart and Pamela Gibson file a joint return reflecting AGI of

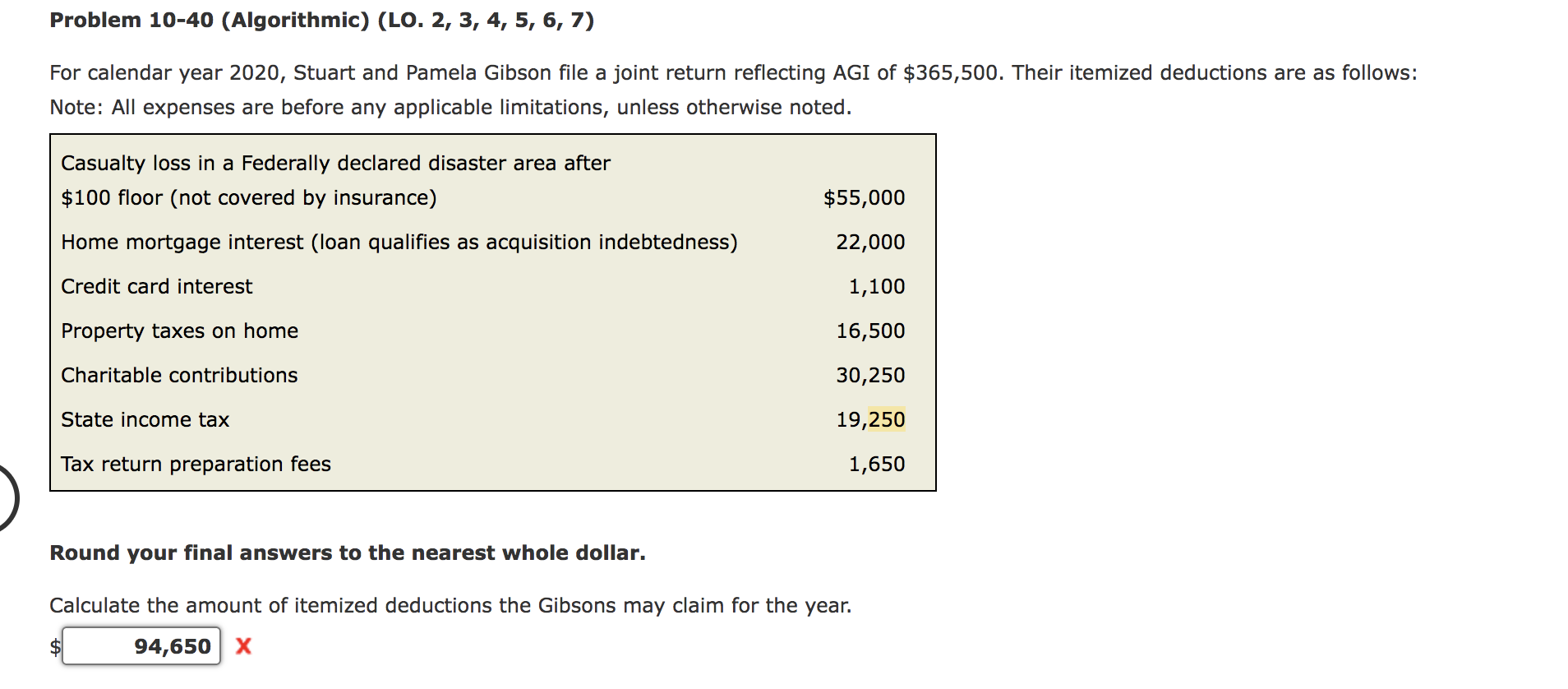

Problem 10-40 (Algorithmic) (LO. 2, 3, 4, 5, 6, 7) For calendar year 2020, Stuart and Pamela Gibson file a joint return reflecting AGI of $365,500. Their itemized deductions are as follows: Note: All expenses are before any applicable limitations, unless otherwise noted. Casualty loss in a Federally declared disaster area after $100 floor (not covered by insurance) $55,000 Home mortgage interest (loan qualifies as acquisition indebtedness) 22,000 Credit card interest 1,100 Property taxes on home 16,500 Charitable contributions 30,250 State income tax 19,250 Tax return preparation fees 1,650 Round your final answers to the nearest whole dollar. Calculate the amount of itemized deductions the Gibsons may claim for the year. 94,650 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts