Question: Problem 10-40 (LO. 3, 6, 7, 9, 10, 11) Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in

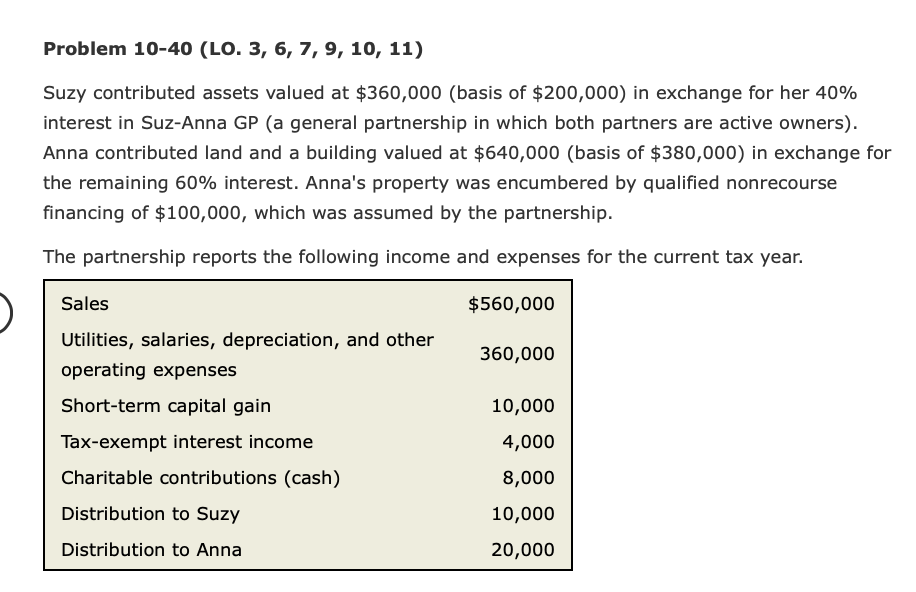

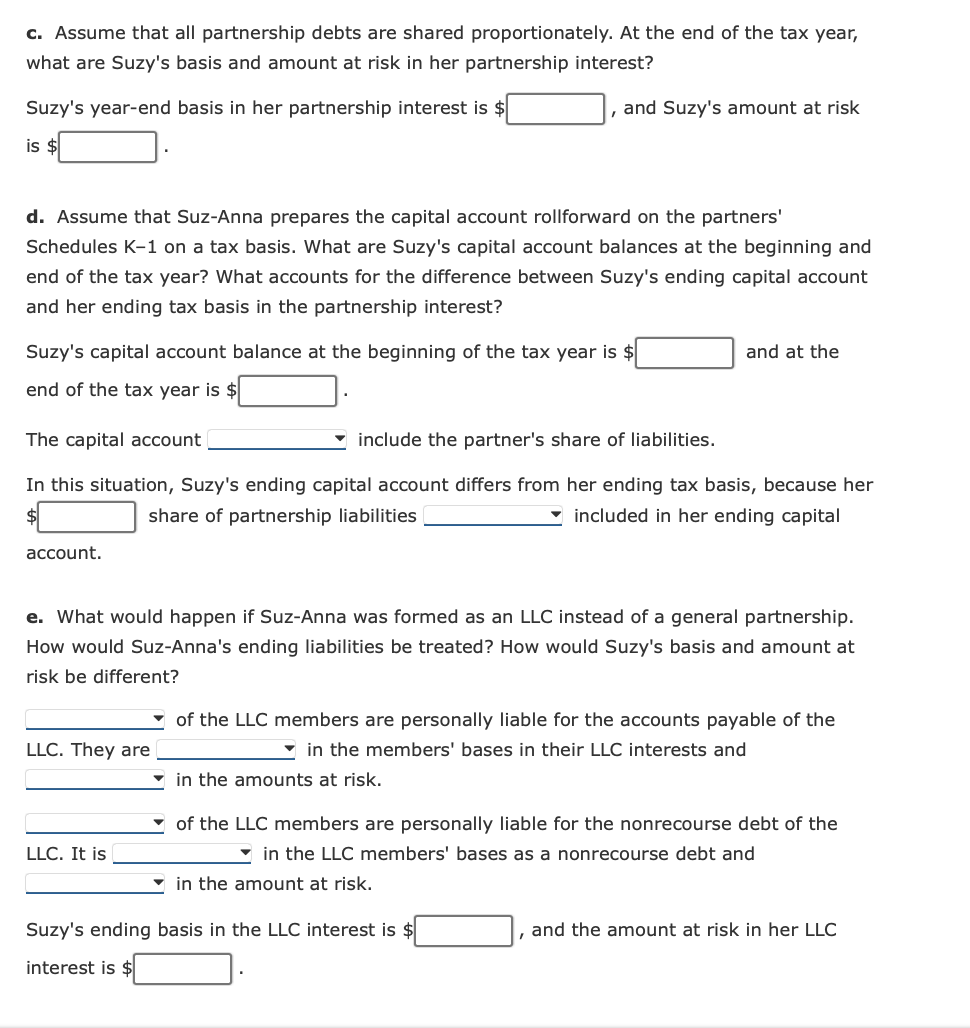

Problem 10-40 (LO. 3, 6, 7, 9, 10, 11) Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna GP (a general partnership in which both partners are active owners). Anna contributed land and a building valued at $640,000 (basis of $380,000) in exchange for the remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. Sales $560,000 360,000 Utilities, salaries, depreciation, and other operating expenses Short-term capital gain Tax-exempt interest income Charitable contributions (cash) Distribution to Suzy Distribution to Anna 10,000 4,000 8,000 10,000 20,000 c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy's basis and amount at risk in her partnership interest? Suzy's year-end basis in her partnership interest is $ and Suzy's amount at risk is $ d. Assume that Suz-Anna prepares the capital account rollforward on the partners' Schedules K-1 on a tax basis. What are Suzy's capital account balances at the beginning and end of the tax year? What accounts for the difference between Suzy's ending capital account and her ending tax basis in the partnership interest? Suzy's capital account balance at the beginning of the tax year is $ and at the end of the tax year is $ The capital account include the partner's share of liabilities. In this situation, Suzy's ending capital account differs from her ending tax basis, because her share of partnership liabilities included in her ending capital account. e. What would happen if Suz-Anna was formed as an LLC instead of a general partnership. How would Suz-Anna's ending liabilities be treated? How would Suzy's basis and amount at risk be different? LLC. They are of the LLC members are personally liable for the accounts payable of the in the members' bases in their LLC interests and in the amounts at risk. LLC. It is of the LLC members are personally liable for the nonrecourse debt of the in the LLC members' bases as a nonrecourse debt and in the amount at risk. Suzy's ending basis in the LLC interest is $ , and the amount at risk in her LLC interest is $ Problem 10-40 (LO. 3, 6, 7, 9, 10, 11) Suzy contributed assets valued at $360,000 (basis of $200,000) in exchange for her 40% interest in Suz-Anna GP (a general partnership in which both partners are active owners). Anna contributed land and a building valued at $640,000 (basis of $380,000) in exchange for the remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. Sales $560,000 360,000 Utilities, salaries, depreciation, and other operating expenses Short-term capital gain Tax-exempt interest income Charitable contributions (cash) Distribution to Suzy Distribution to Anna 10,000 4,000 8,000 10,000 20,000 c. Assume that all partnership debts are shared proportionately. At the end of the tax year, what are Suzy's basis and amount at risk in her partnership interest? Suzy's year-end basis in her partnership interest is $ and Suzy's amount at risk is $ d. Assume that Suz-Anna prepares the capital account rollforward on the partners' Schedules K-1 on a tax basis. What are Suzy's capital account balances at the beginning and end of the tax year? What accounts for the difference between Suzy's ending capital account and her ending tax basis in the partnership interest? Suzy's capital account balance at the beginning of the tax year is $ and at the end of the tax year is $ The capital account include the partner's share of liabilities. In this situation, Suzy's ending capital account differs from her ending tax basis, because her share of partnership liabilities included in her ending capital account. e. What would happen if Suz-Anna was formed as an LLC instead of a general partnership. How would Suz-Anna's ending liabilities be treated? How would Suzy's basis and amount at risk be different? LLC. They are of the LLC members are personally liable for the accounts payable of the in the members' bases in their LLC interests and in the amounts at risk. LLC. It is of the LLC members are personally liable for the nonrecourse debt of the in the LLC members' bases as a nonrecourse debt and in the amount at risk. Suzy's ending basis in the LLC interest is $ , and the amount at risk in her LLC interest is $

Step by Step Solution

There are 3 Steps involved in it

To solve the questions lets break them down into parts c Suzys Basis and Amount at Risk Initial Basi... View full answer

Get step-by-step solutions from verified subject matter experts