Question: Problem 10-5 Sensitivity Analysis (LO3) A project currently generates sales of $10 million, variable costs equal 50% of sales, and fixed costs are $2 million.

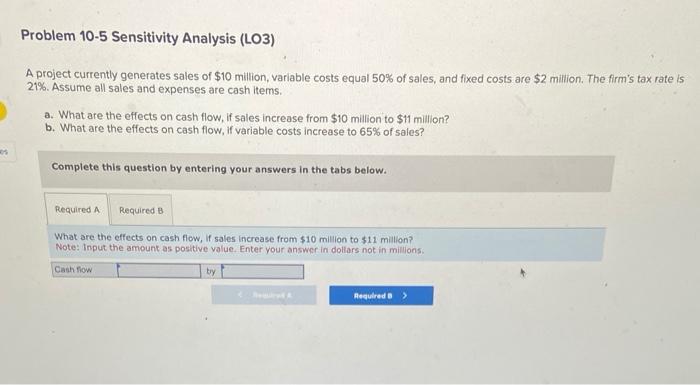

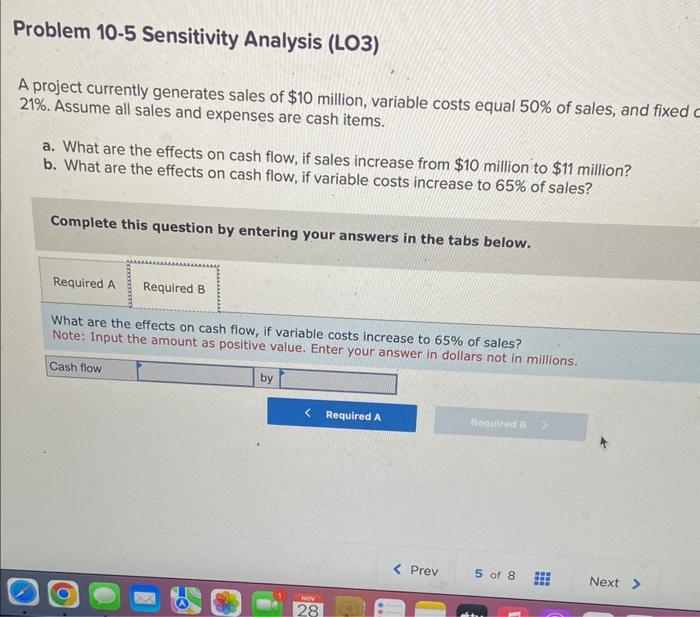

Problem 10-5 Sensitivity Analysis (LO3) A project currently generates sales of $10 million, variable costs equal 50% of sales, and fixed costs are $2 million. The firm's tax rate is 21\%. Assume all sales and expenses are cash items. a. What are the effects on cash flow, if sales increase from $10 million to $11 million? b. What are the effects on cash flow, if variable costs increase to 65% of sales? Complete this question by entering your answers in the tabs below. What are the effects on cash flow, If sales increase from $10 million to $11 million? Note: input the amount as positive value. Enter your answer in dollars not in millions. A project currently generates sales of $10 million, variable costs equal 50% of sales, and fixed 21\%. Assume all sales and expenses are cash items. a. What are the effects on cash flow, if sales increase from $10 million to $11 million? b. What are the effects on cash flow, if variable costs increase to 65% of sales? Complete this question by entering your answers in the tabs below. What are the effects on cash flow, if variable costs increase to 65% of sales? Note: Input the amount as positive value. Enter your answer in dollars not in millions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts