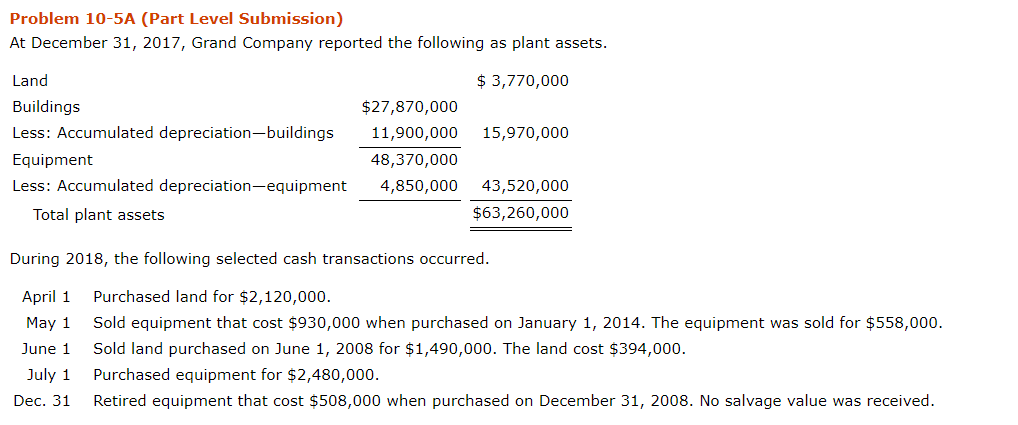

Question: Problem 10-5A (Part Level Submission) At December 31, 2017, Grand Company reported the following as plant assets. Land Buildings Less: Accumulated depreciation-buildings 11,900,000 15,970,000 Equipment

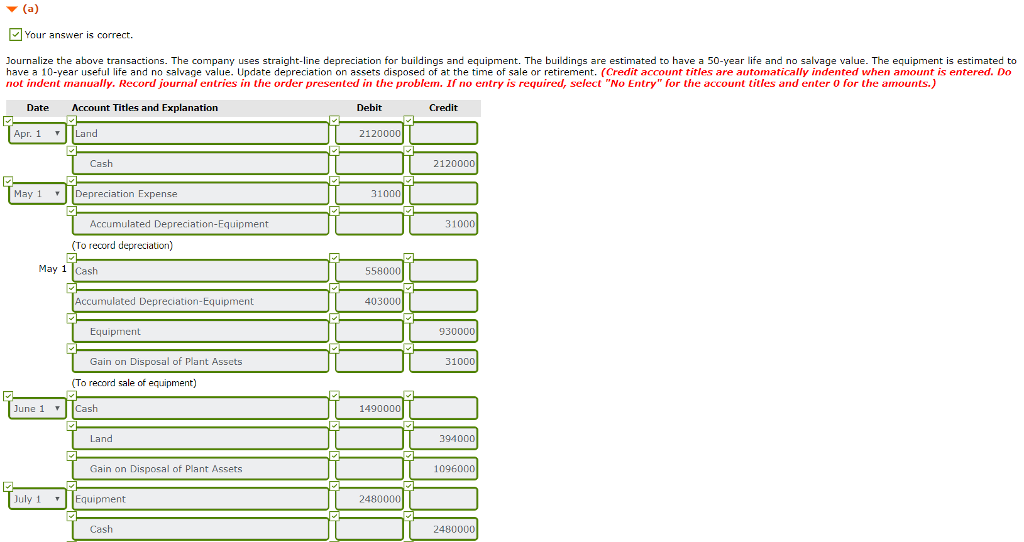

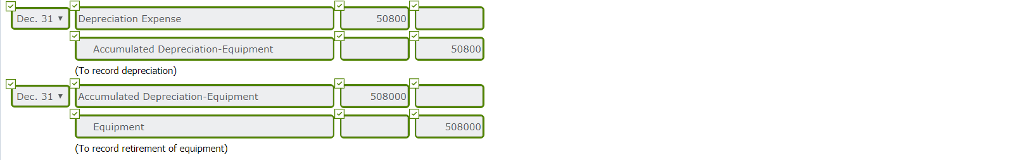

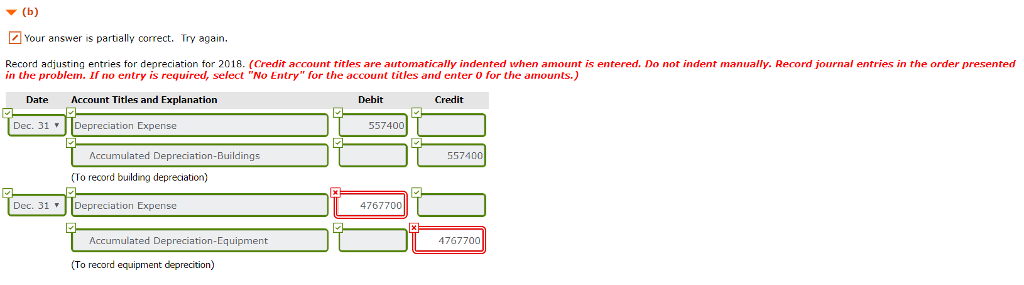

Problem 10-5A (Part Level Submission) At December 31, 2017, Grand Company reported the following as plant assets. Land Buildings Less: Accumulated depreciation-buildings 11,900,000 15,970,000 Equipment Less: Accumulated depreciation-equipment 4,850,000 43,520,000 $3,770,000 $27,870,000 48,370,000 Total plant assets $63,260,000 During 2018, the following selected cash transactions occurred. April 1 Purchased land for $2,120,000. May 1 Sold equipment that cost $930,000 when purchased on January 1, 2014. The equipment was sold for $558,000 June 1 Sold land purchased on June 1, 2008 for $1,490,000. The land cost $394,000 July 1 Purchased equipment for $2,480,000 Dec. 31 Retired equipment that cost $508,000 when purchased on December 31, 2008. No salvage value was received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts