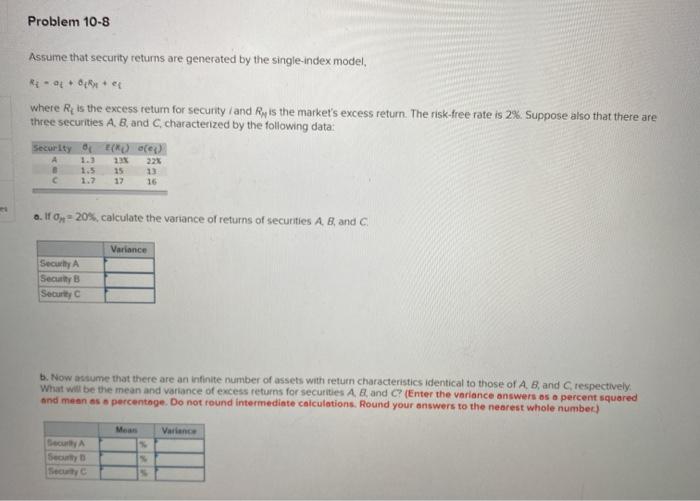

Question: Problem 10-8 Assume that security returns are generated by the single-index model, REL. + where Re is the excess return for security and Ry is

Problem 10-8 Assume that security returns are generated by the single-index model, REL. + where Re is the excess return for security and Ry is the market's excess return. The risk-free rate is 2%. Suppose also that there are three securities A, B, and characterized by the following data: Security ) () 1.3 12 A 8 C 1.5 15 17 23 16 a. It On - 20%, calculate the variance of returns of securities A8, and C Variance Security Security Security b. Now assume that there are an infinite number of assets with return characteristics identical to those of A, B, and respectively What will be the mean and variance of excess returns for securities A and C? (Enter the variance answers as a percent squared and meen as a percentage. Do not round intermediate calculations. Round your answers to the nearest whole number) Meas Variance BA Secay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts