Question: Problem 10-8A Note payable, warranty expense, and liability LO3, 4 Western Refrigeration borrowed $230,000 to purchase inventory on September 15, 2020 for 45 days at

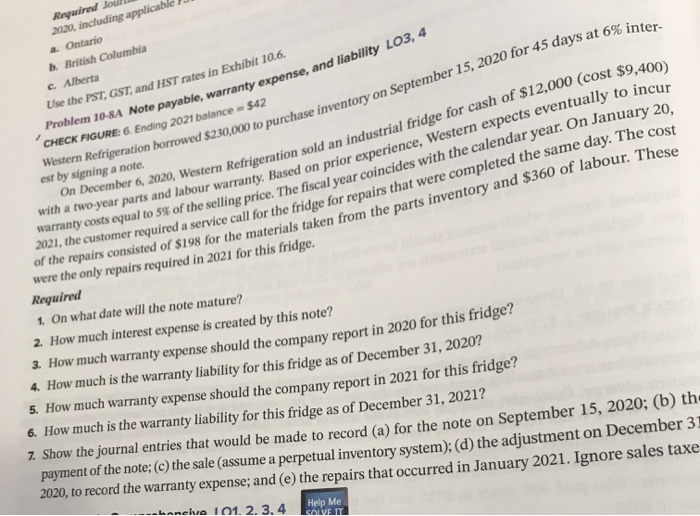

Problem 10-8A Note payable, warranty expense, and liability LO3, 4 Western Refrigeration borrowed $230,000 to purchase inventory on September 15, 2020 for 45 days at 6% inter- On December 6, 2020, Western Refrigeration sold an industrial fridge for cash of $12,000 (cost $9,400) with a two-year parts and labour warranty. Based on prior experience, Western expects eventually to incur warranty costs equal to 5% of the selling price. The fiscal year coincides with the calendar year. On January 20, 2021, the customer required a service call for the fridge for repairs that were completed the same day. The cost Required to 2020, including applicat a. Ontario b. British Columbia C. Alberta Use the PST, GST, and HST rates in Exhibit 10.6. CHECK FIGURE 6. Ending 2021 balance = $42 est by signing a note were the only repairs required in 2021 for this fridge. Required 1. On what date will the note mature? 2. How much interest expense is created by this note? 3. How much warranty expense should the company report in 2020 for this fridge? 4. How much is the warranty liability for this fridge as of December 31, 2020? 5. How much warranty expense should the company report in 2021 for this fridge? 6. How much is the warranty liability for this fridge as of December 31, 2021? 7. Show the journal entries that would be made to record (a) for the note on September 15, 2020; (b) th payment of the note; (c) the sale (assume a perpetual inventory system); (d) the adjustment on December 31 2020, to record the warranty expense; and (e) the repairs that occurred in January 2021. Ignore sales taxe Help Me baneive 101. 2. 3. 4 SOLVE IT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts