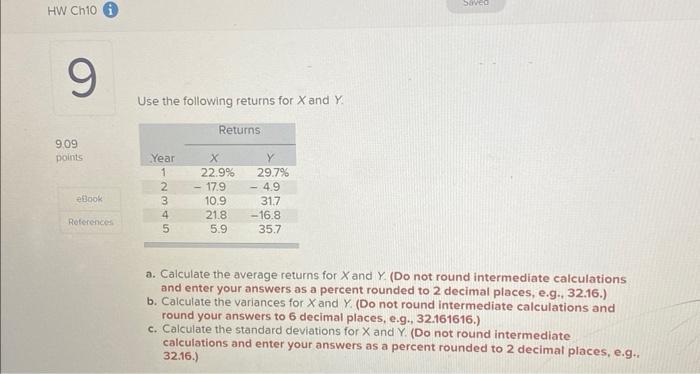

Question: Problem 10-9 Calculating Returns and Variability [LO 1] You've observed the following returns on Yamauchi Corporation's stock over the past five years: -24.6 percent, 13.4

![Problem 10-9 Calculating Returns and Variability [LO 1] You've observed the](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67038bd999163_65767038bd93381c.jpg)

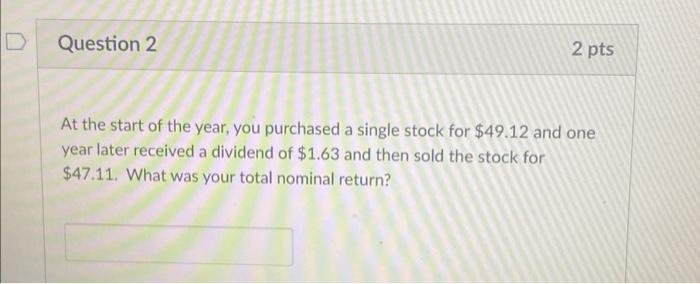

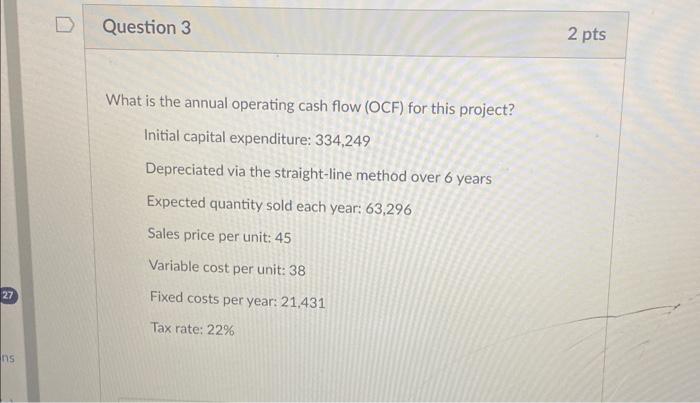

Problem 10-9 Calculating Returns and Variability [LO 1] You've observed the following returns on Yamauchi Corporation's stock over the past five years: -24.6 percent, 13.4 percent, 29.8 percent, 2.2 percent, and 21.2 percent. a. What was the arithmetic average return on the stock over this five-year period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What was the variance of the returns over this period? (Do not round intermediate calculations and round your answer to 6 decimal places, e.g., 32.161616.) c. What was the standard devlation of the returns over this period? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Use the following returns for X and Y. a. Calculate the average returns for X and Y. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the variances for X and Y. (Do not round intermediate calculations and round your answers to 6 decimal places, e.g., 32.161616.) c. Calculate the standard deviations for X and Y. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g. 32.16.) At the start of the year, you purchased a single stock for $49.12 and one year later received a dividend of $1.63 and then sold the stock for $47.11. What was your total nominal return? What is the annual operating cash flow (OCF) for this project? Initial capital expenditure: 334,249 Depreciated via the straight-line method over 6 years Expected quantity sold each year: 63,296 Sales price per unit: 45 Variable cost per unit: 38 Fixed costs per year: 21.431 Tax rate: 22%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts