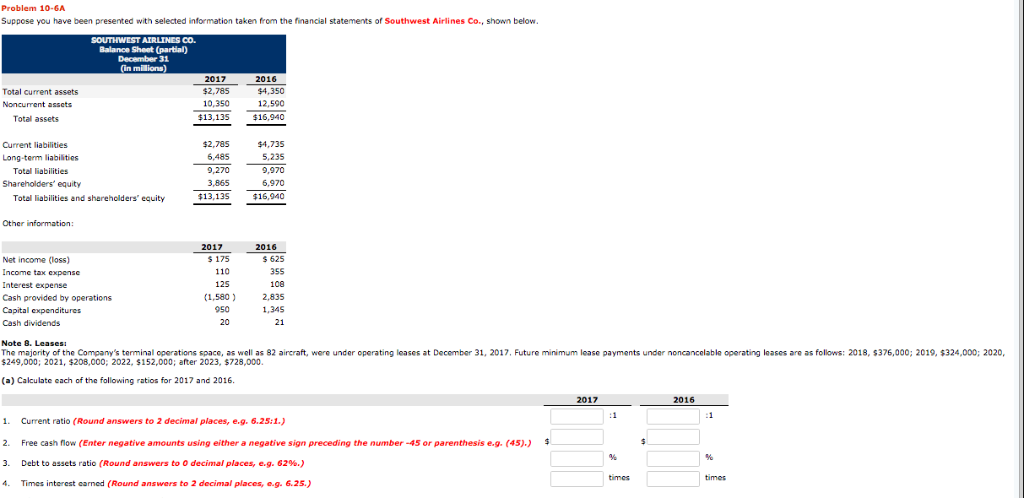

Question: Problem 10-GA Suppose you have been presented with selected information taken from the financial statements of Southwest Airlines Co., shown below. Balance Sheet (partial) December

Problem 10-GA Suppose you have been presented with selected information taken from the financial statements of Southwest Airlines Co., shown below. Balance Sheet (partial) December 31 (in milions) 2017 $2,785 10,350 $13,135 2016 $4,350 12,590 Total current assets Noncurrent asscts Total assets $16,940 2,785 6,485 9,270 3,865 $13,13S 4.735 5,235 9,970 6,970 $16,940 Current liabilities Long-term liabilities Totel liabilities Shareholders' equity Total liabilities and shareholders equity Other information: 2017 2016 s 175 110 12S 625 Net income (loss) Income tax expense Interest expense Cash proided by operations Copital expenditures Cash dividends 108 1,5802,835 1,345 21 950 20 Note B. Leasesi The majority of the Company's terminal operations space, as well as 82 aircraft, were under operating leases at Decomber 31, 2017, Future minimum lease payments under noncancelable operating leases are as follows: 2018, $376,000; 2019, $324,000; 2020 $249,000; 2021, $208,000;: 2022, $152,000; after 2023, $728,000. (a) Calculate each of the following ratios for 2017 and 2016 2017 2016 1. Current ratio (Round answers to 2 decimal places, e.g. 6.25:1. 2. Free cash flow (Enter negative amounts using either a negative sign preceding the numtber-45 or parenthesis e.g. (45).) 3. Debt to assets ratio (Round answers to 0 decimal places, e.g. 62%.) 4. Times interest carned (Round answers to 2 decimal places, e.g.6.25.) times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts