Question: Problem #11 (10 Points) During the year, Rita rented her vacation home for 12 days for $2,400.00. She used it personally for three months and

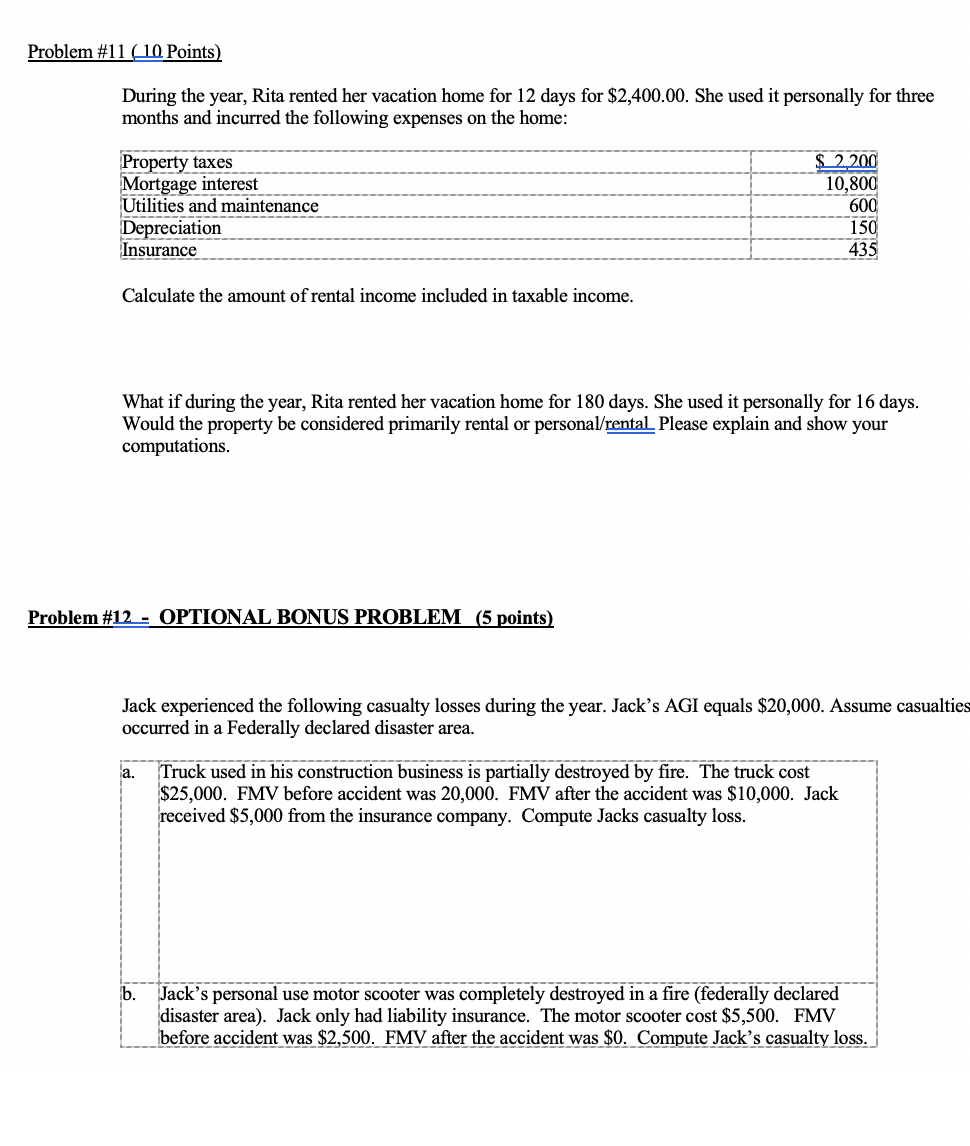

Problem #11 (10 Points) During the year, Rita rented her vacation home for 12 days for $2,400.00. She used it personally for three months and incurred the following expenses on the home: ---------------------------------------- Property taxes Mortgage interest Utilities and maintenance Depreciation Insurance $ 2.200 10,800 600 150 Calculate the amount of rental income included in taxable income. What if during the year, Rita rented her vacation home for 180 days. She used it personally for 16 days. Would the property be considered primarily rental or personal/rental. Please explain and show your computations. Problem #12 - OPTIONAL BONUS PROBLEM (5 points) Jack experienced the following casualty losses during the year. Jack's AGI equals $20,000. Assume casualties occurred in a Federally declared disaster area. a. Truck used in his construction business is partially destroyed by fire. The truck cost $25,000. FMV before accident was 20,000. FMV after the accident was $10,000. Jack received $5,000 from the insurance company. Compute Jacks casualty loss. b. Jack's personal use motor scooter was completely destroyed in a fire (federally declared disaster area). Jack only had liability insurance. The motor scooter cost $5,500. FMV before accident was $2,500. FMV after the accident was $0. Compute Jack's casualty loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts